The Bill Status Report is a comprehensive tool designed to help users track the progress and status of various bills within a specified period. This report provides detailed insights into billing activities, including outstanding payments, due dates, and payment histories, ensuring that users can manage their financial obligations effectively.

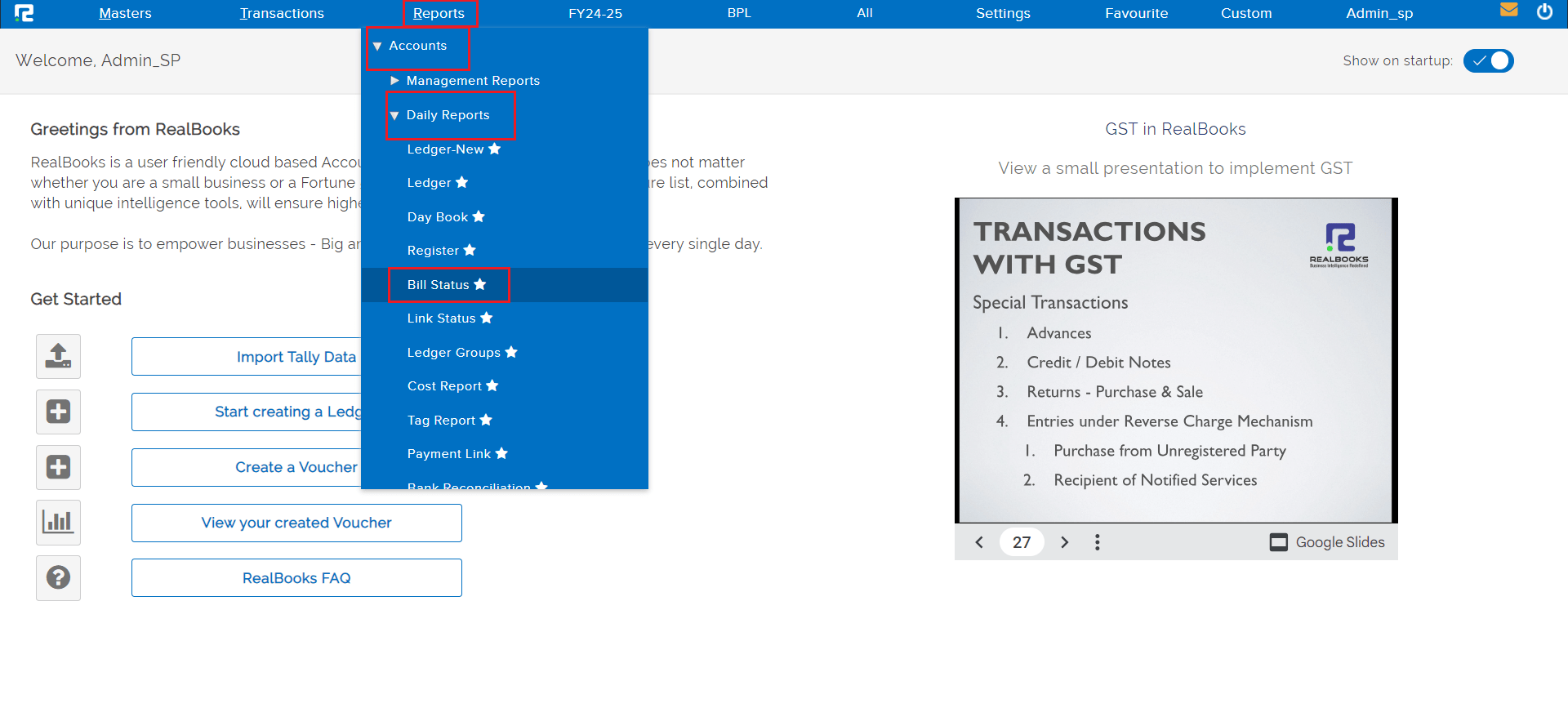

To View the Bill Status Report:

Go to Reports => Accounts => Daily Reports => Bill Status

A Bill Status Report Page will open.

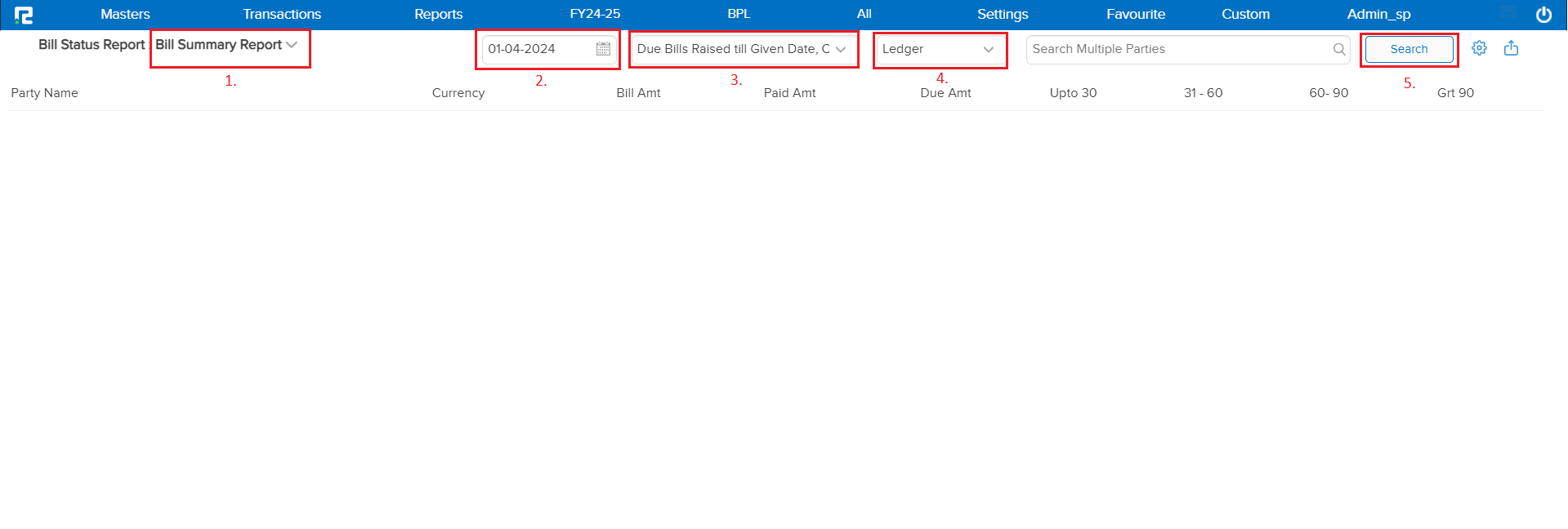

By default, the report variation page is set to Bill Summary Report. This variation of the Bill Status Report shows a snapshot with a consolidated summary of all bills. It includes the total outstanding balance along with aging breakdowns.

Use Case: Ideal for a quick glance at overall billing activities, helping in understanding the total receivables and payables.

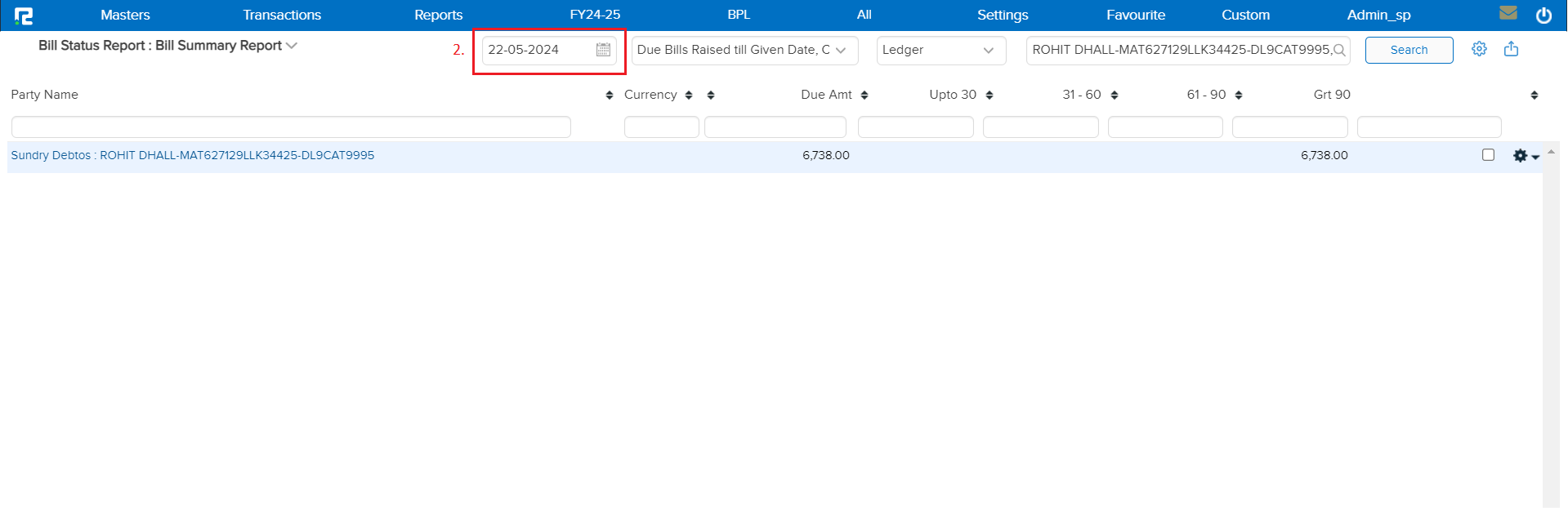

2. Date: Set the date range for which the Report data needs to be searched.

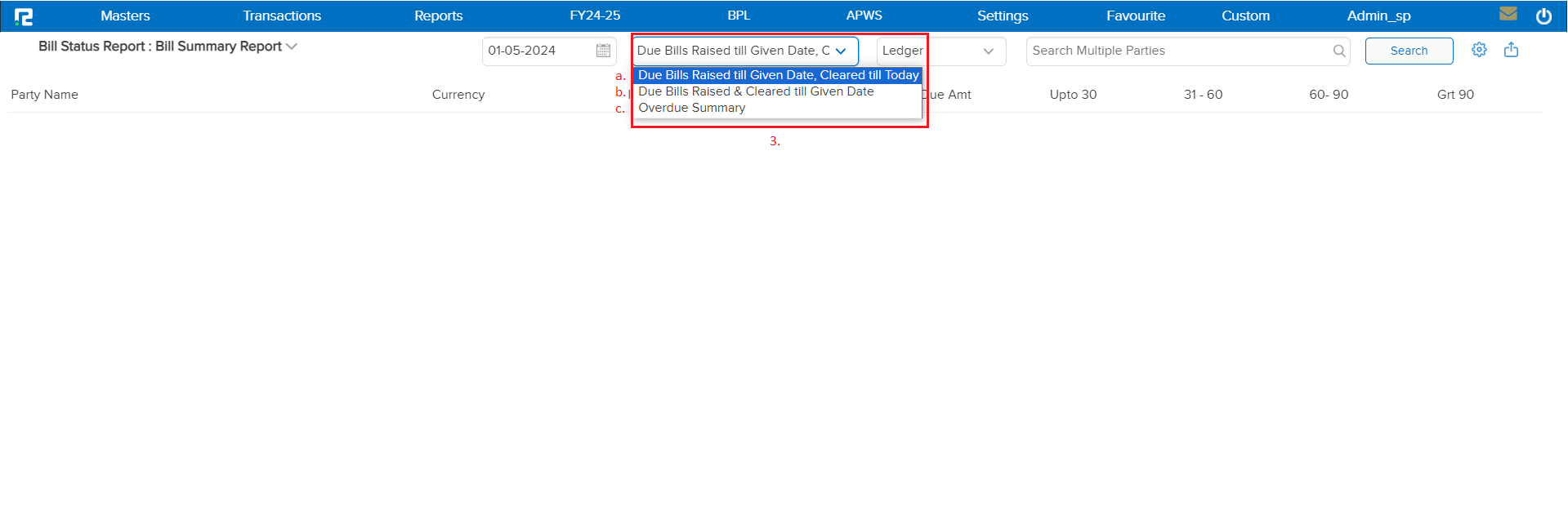

3. Filters: The Filter option in the bill status report enables users to refine their view of bills based on their due dates. Here is how it might work:

a. Due Bills Raised Till Given Date, Cleared Till Today – This filter will be set to show bills with the consolidated value that have been raised and cleared up to the current date.

b. Due Bills Raised & Cleared Till Given Date – By using this filter it allows you to generate a report for bills that were issued on a specific date and have been cleared by the selected date. Additionally, you can see which bills were raised on a certain day and track their payment status up until the date you choose.

c. Overdue Summary – If the party exceeds the credit period, the amount will be recorded as overdue in the books. By applying this filter, you can view a summary of the bills, including the specified credit period, Non-overdue amounts along with any overdue amounts.

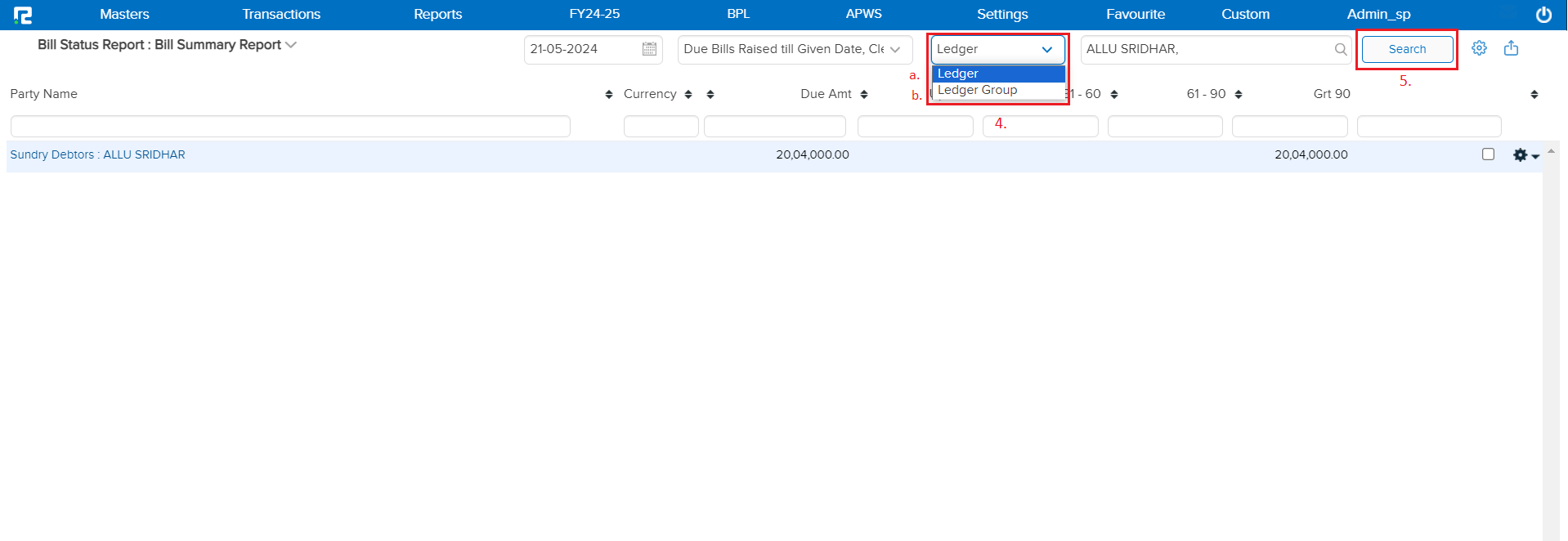

4. Search Options: Select whether you want to search the report by ledger or ledger group.

5. Search: Search and Select the ledger or ledger group name.

Click on “Search” and the list of transactions will appear.

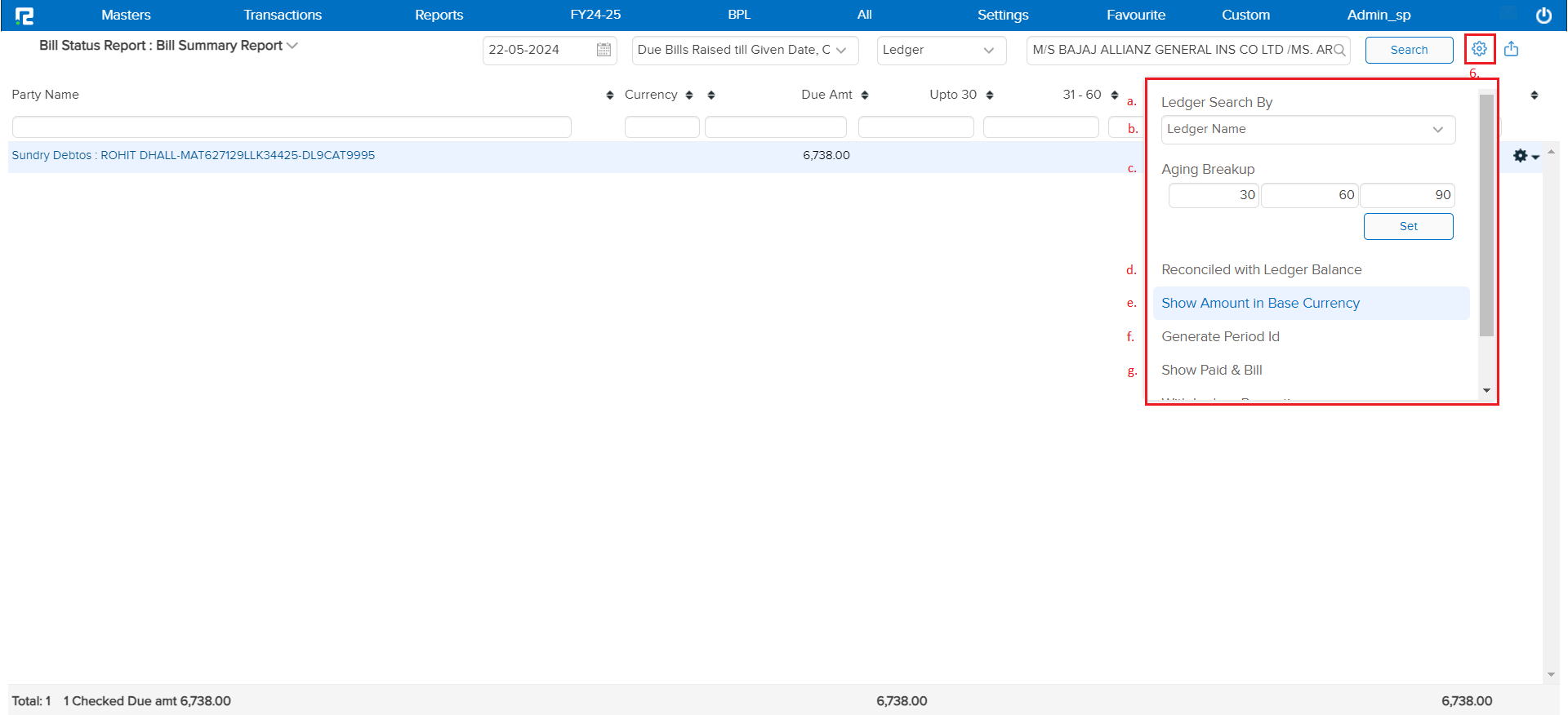

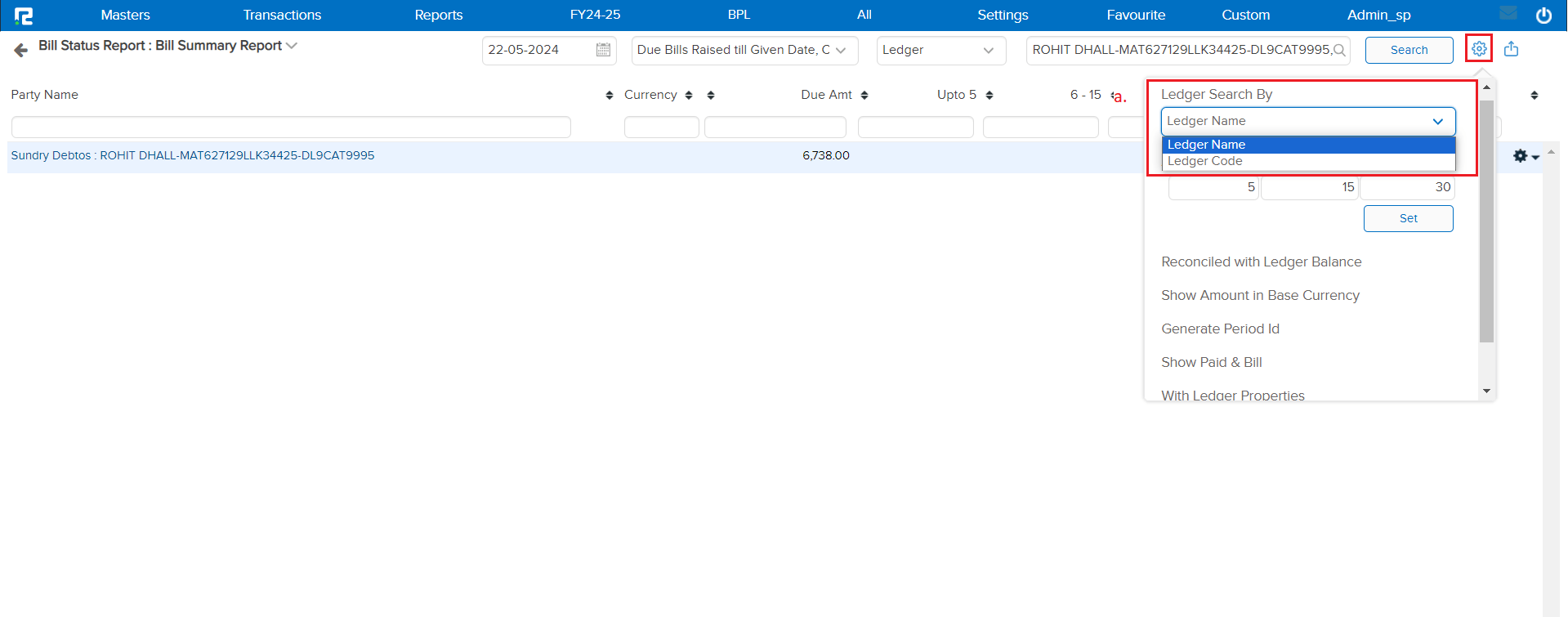

Once the data is displayed on the screen, click on the Gear icon to explore more.

a. Ledger Search By: You can view the report by using both the available option “Ledger Name or the Ledger Code”.

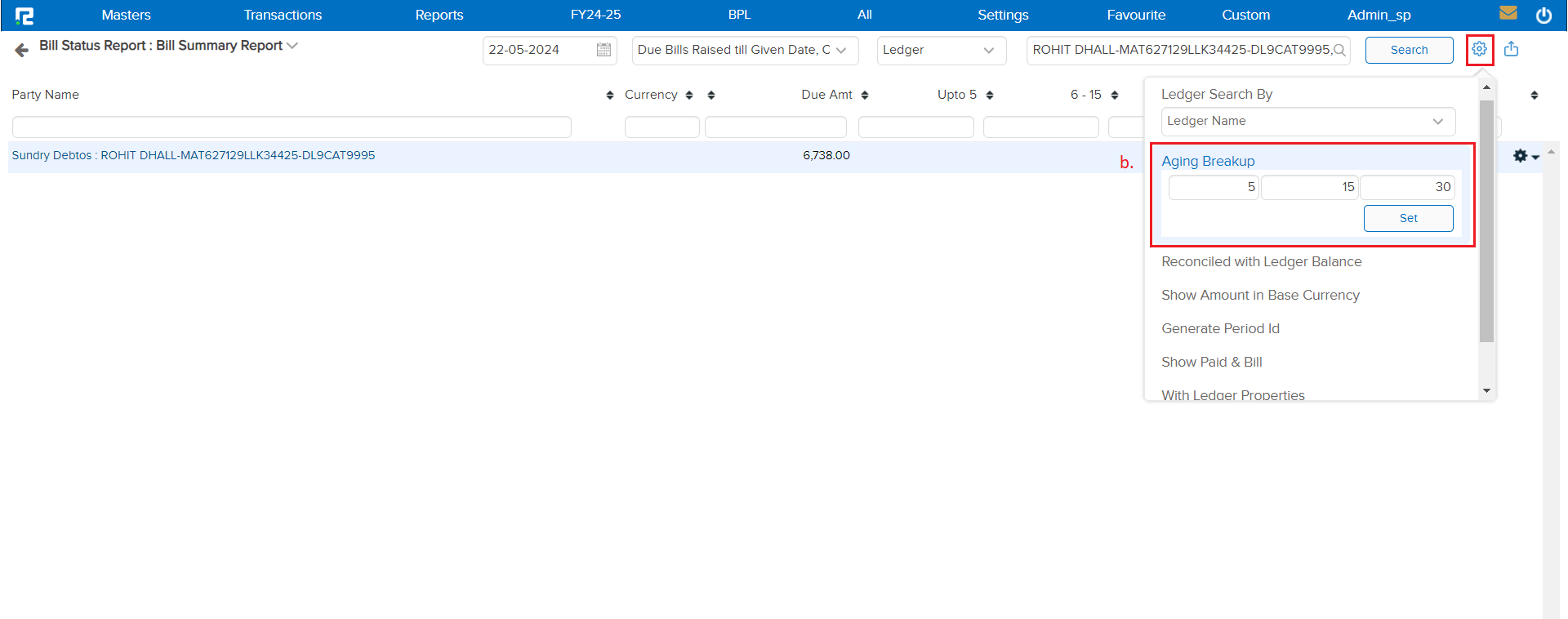

b. Aging Breakup: By default, the aging periods will be selected as (30, 60, or 90 days) to view the outstanding dues based on different time frames. Click “Set” to apply the Custom Period.

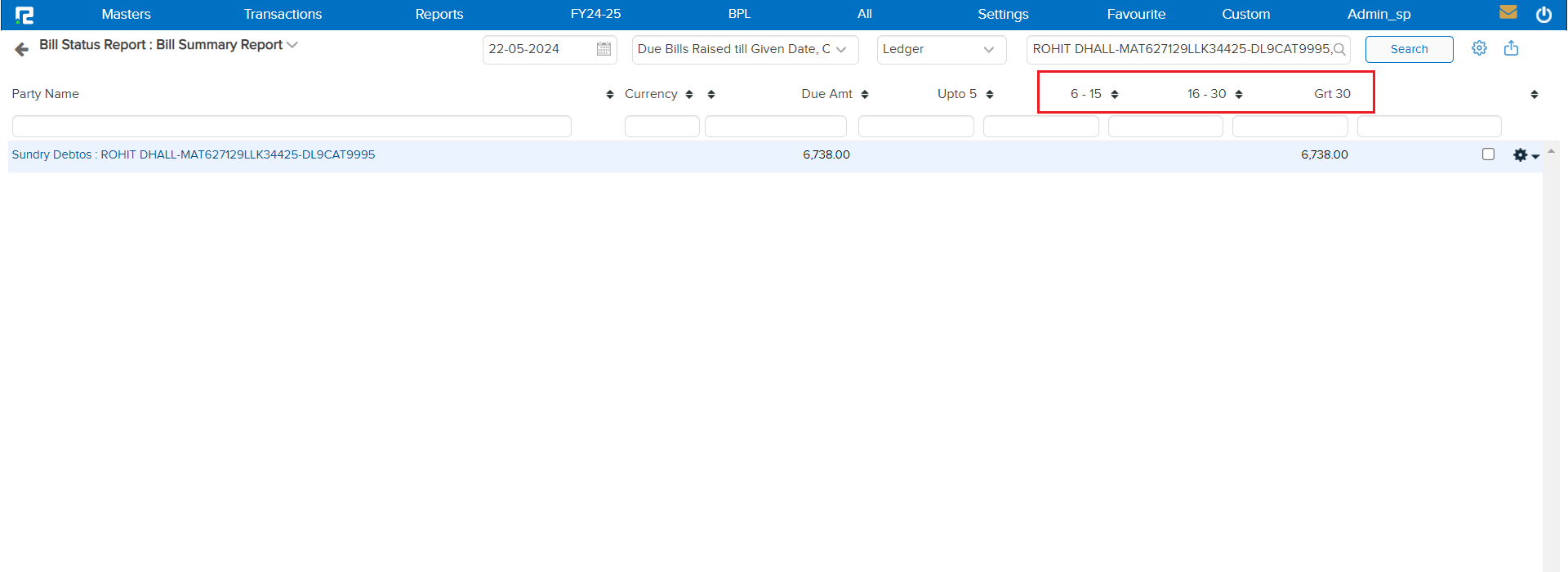

If you have set the aging periods to ( 5, 15, or 30 days), the report will show the report will show Outstanding amounts that are due within these periods, it will help in understanding the aging or receivables.

c. Reconciled with Ledger Balance: This option ensures that the report displays only the bills that are reconciled with the ledger balance. It helps in verifying that all entries match the ledger records.

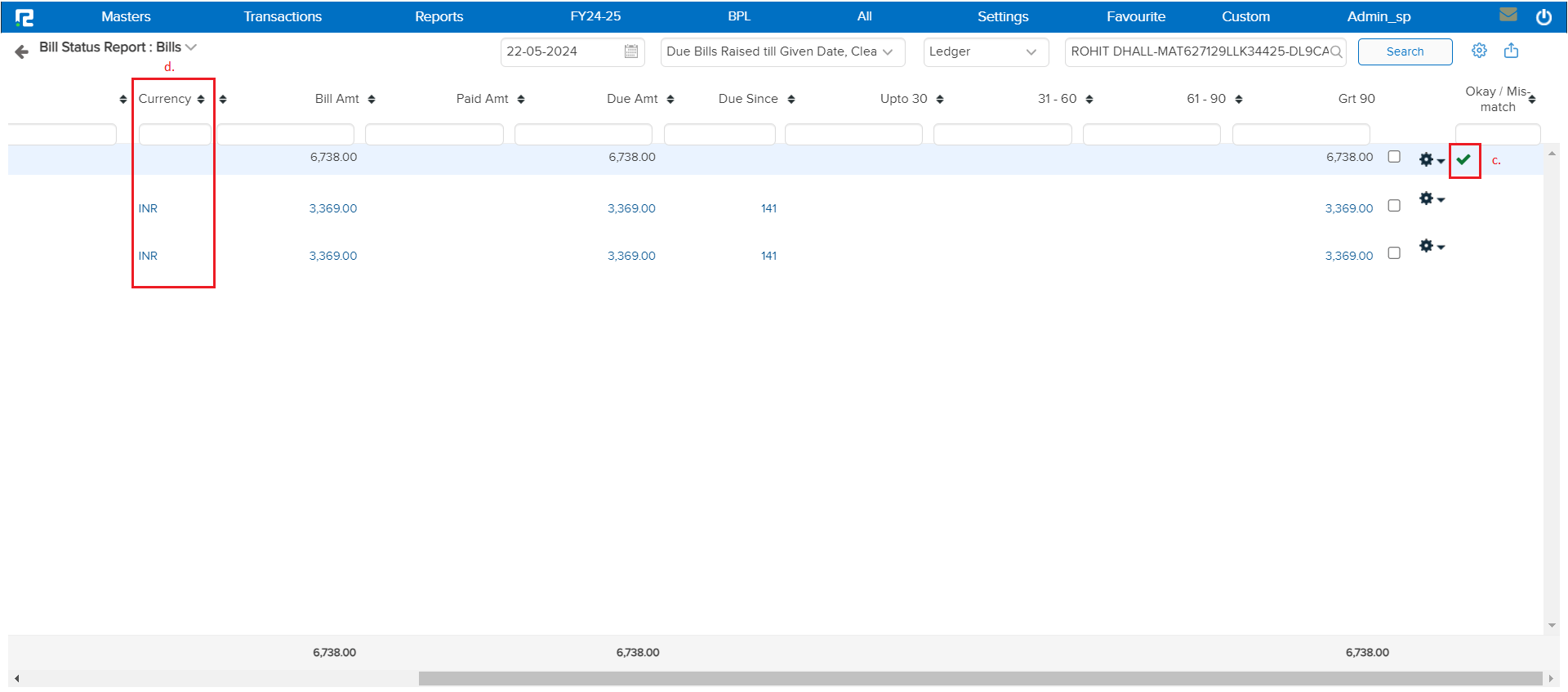

d. Show Amount in Base Currency: This feature converts and displays all amounts in the company’s base currency. This is useful for those companies that are dealing with multiple currencies, ensuring consistency in financial reporting.

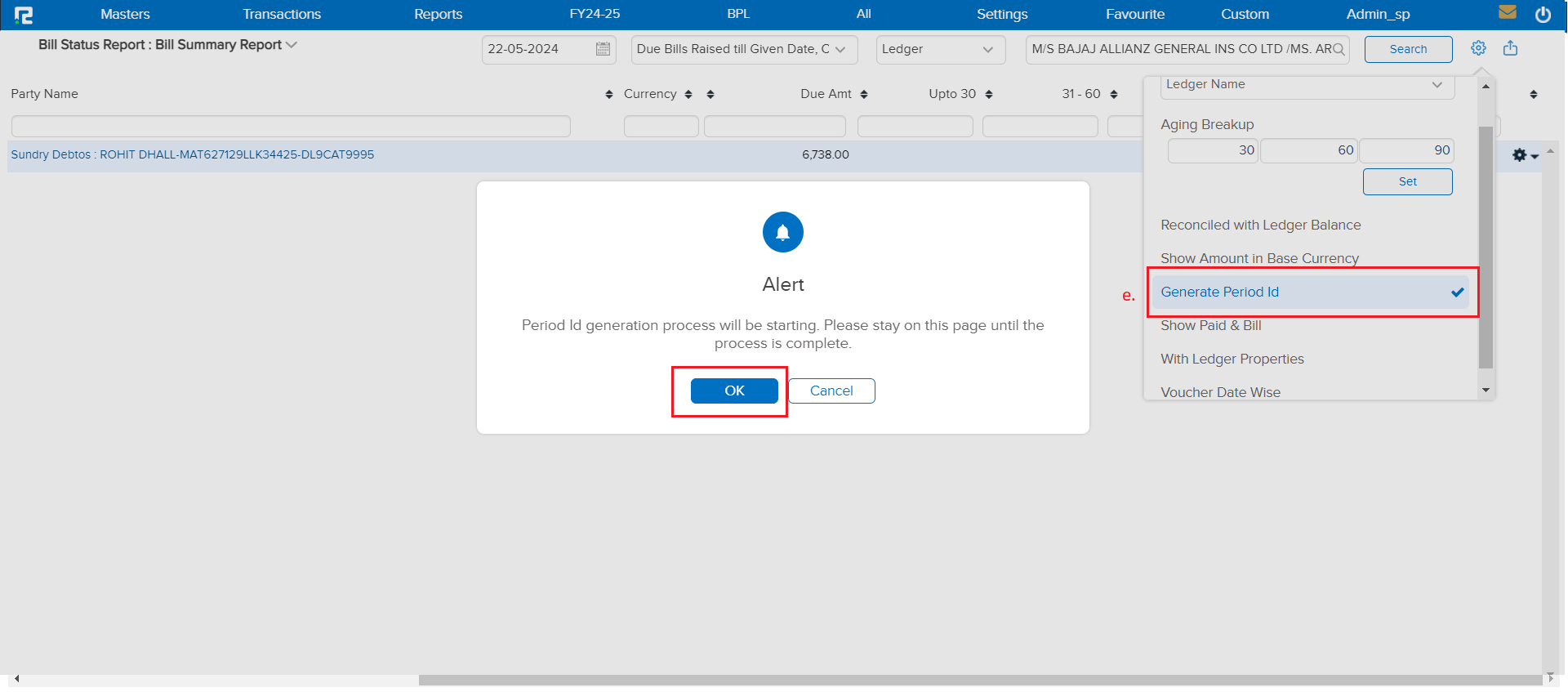

e. Generate Period Id: The feature creates a unique identifier for the reporting period. This can be used for tracking and referencing specific reporting periods. A pop-up will appear to approve the period report generation; click “OK” to confirm.

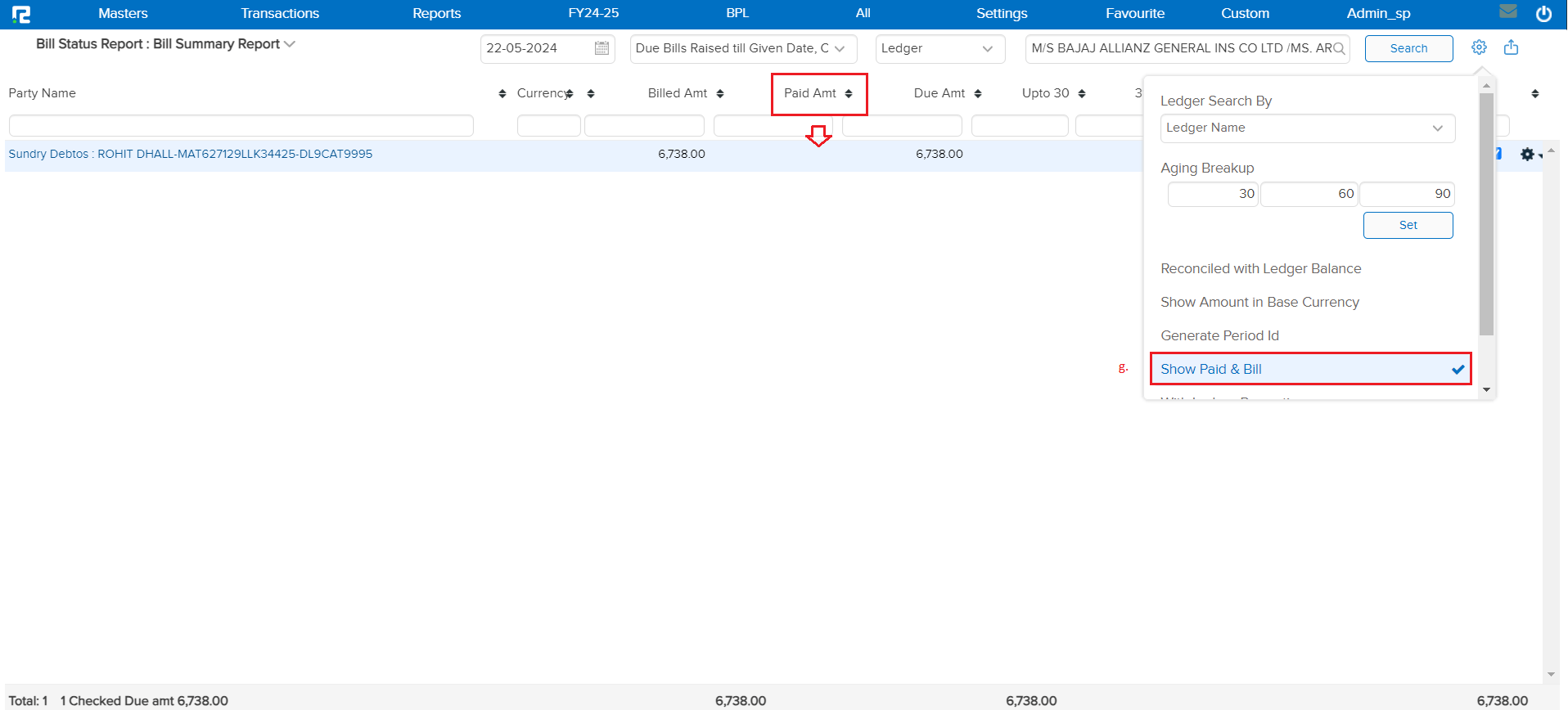

f. Show Paid & Bill: This feature includes both paid and unpaid bills in the report. This gives a comprehensive view of all transactions, not just the outstanding ones.

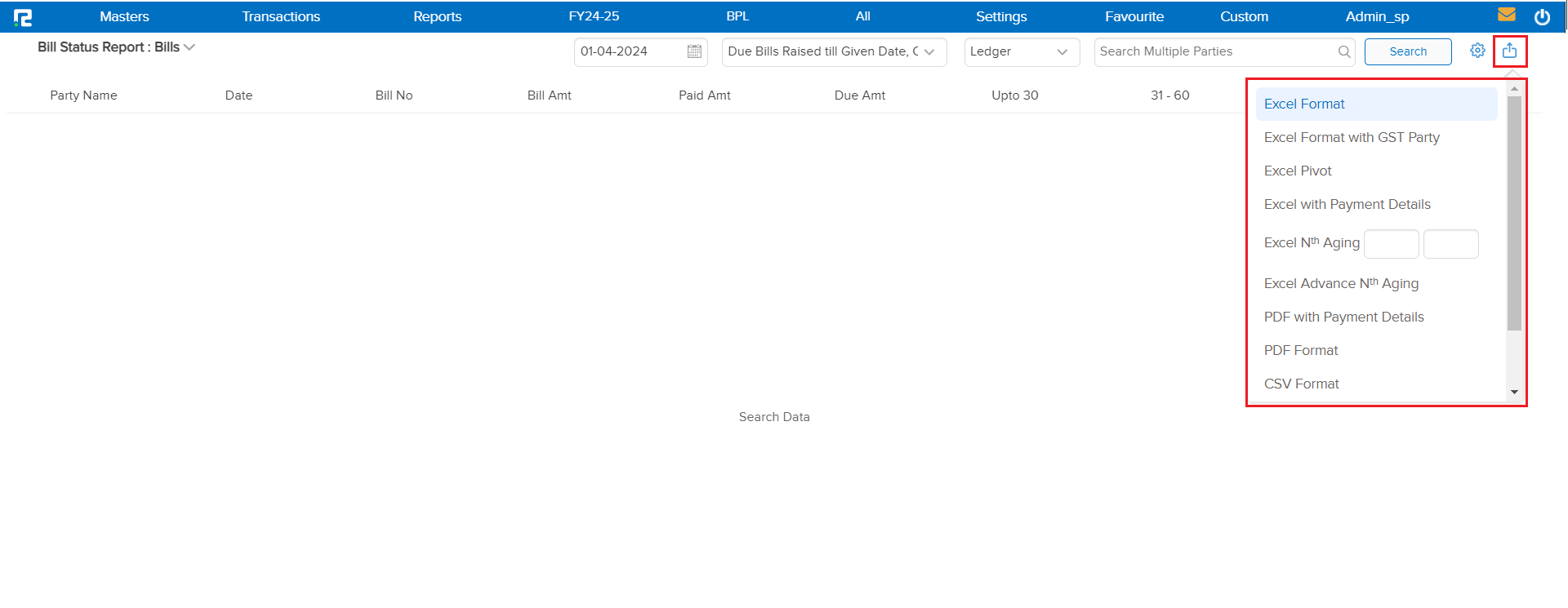

Export – To export the data select the appropriate template from the EXPORT dropdown list.

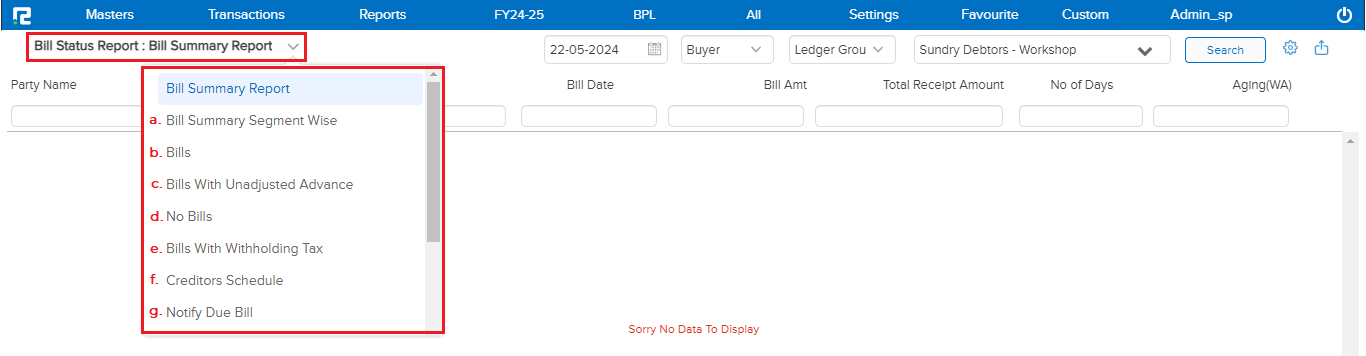

To access different types of Reports under Sale Register(namely report variation) click on the Standard option on the left-hand side of the page.

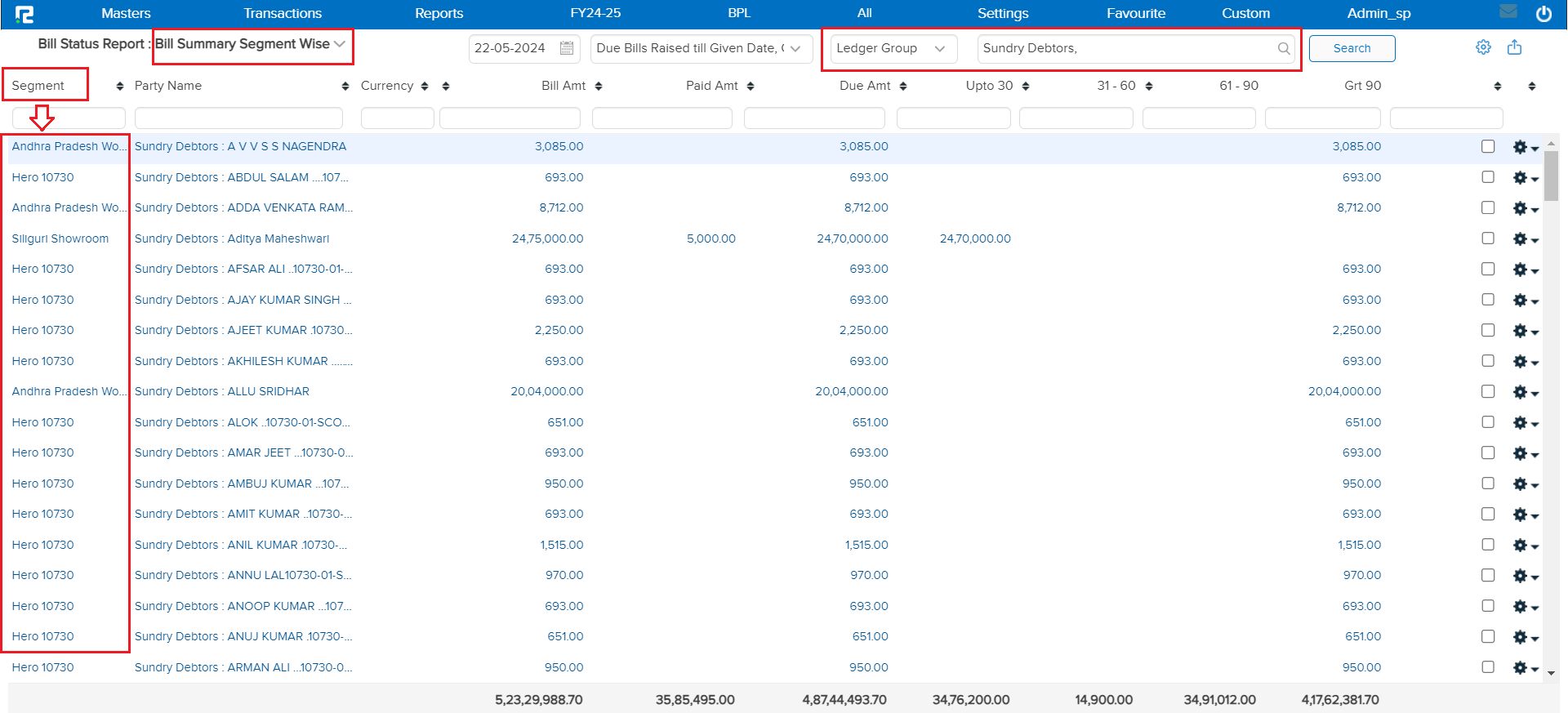

a. Bill Summary Segment Wise

This report breaks down the bill summary into “Segment-wise” receivable, payable, and outstanding amounts. This detailed segmentation aids in analyzing billing data for more comprehensive financial insights.

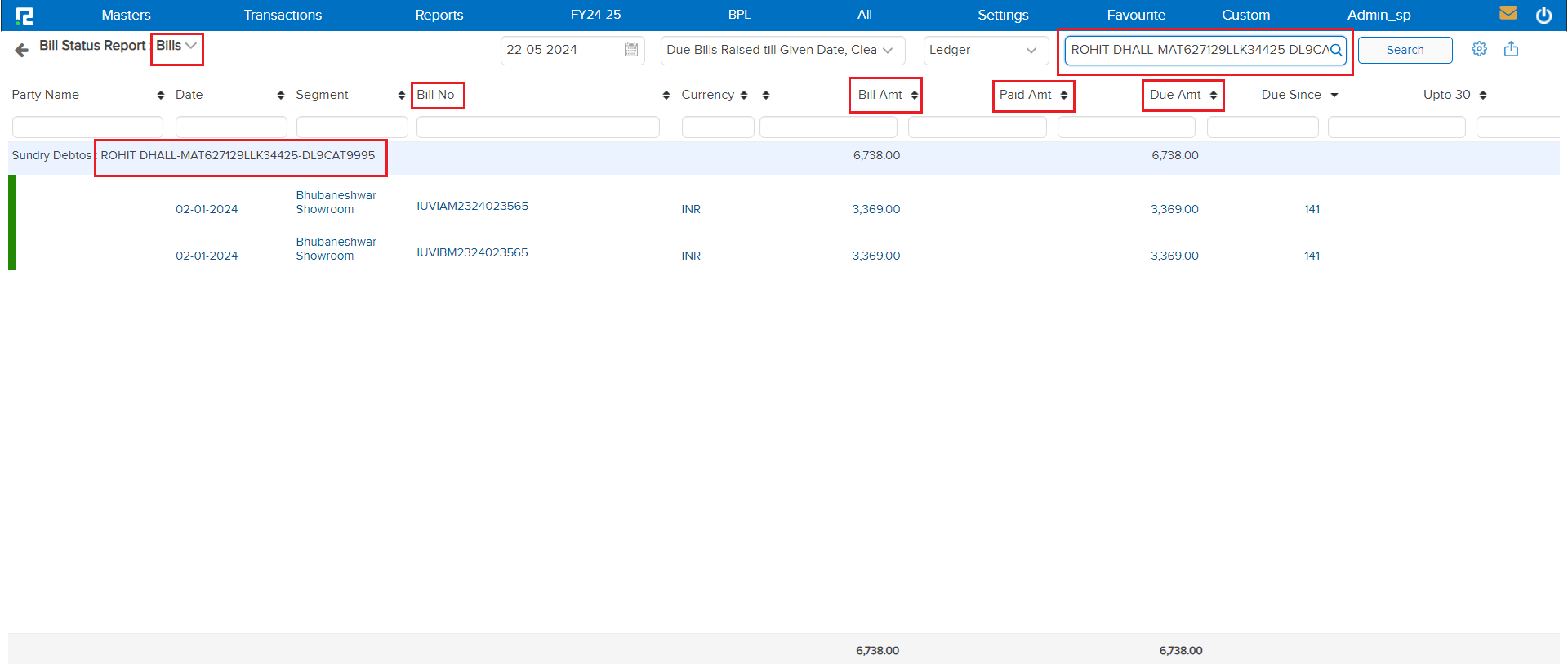

b. Bills

This report lists all bills with details including the bill date, bill number, Currency, bill amount, Paid amount, due amount, due days time span, and current status (paid, unpaid, or overdue).

Use Case: Serves as a comprehensive list for reviewing all billing transactions.

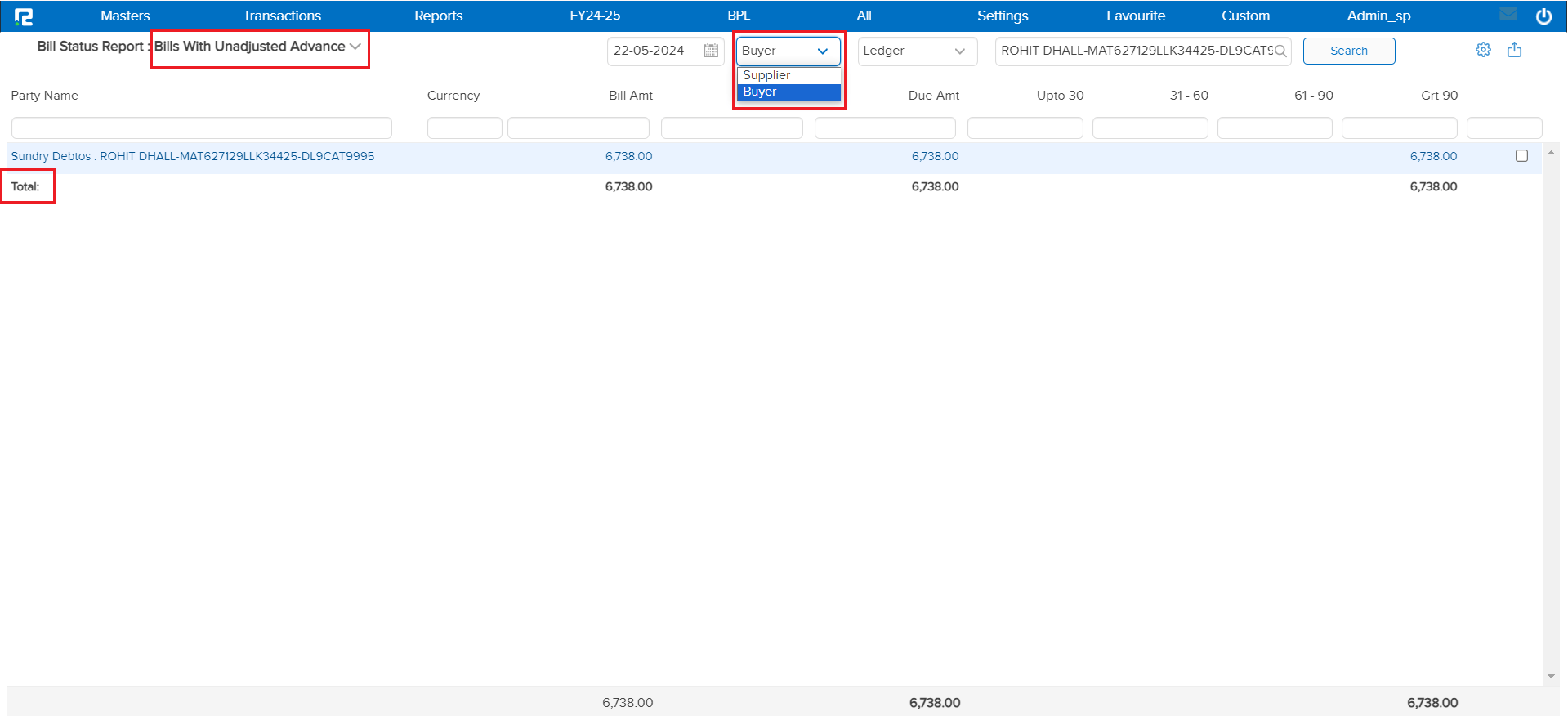

c. Bills With Unadjusted Advance

This report identifies bills that have associated advances or prepayments that have not yet been reconciled.

Use Case: Helps in tracking and managing advances, ensuring that all prepayments are appropriately adjusted against the respective bills.

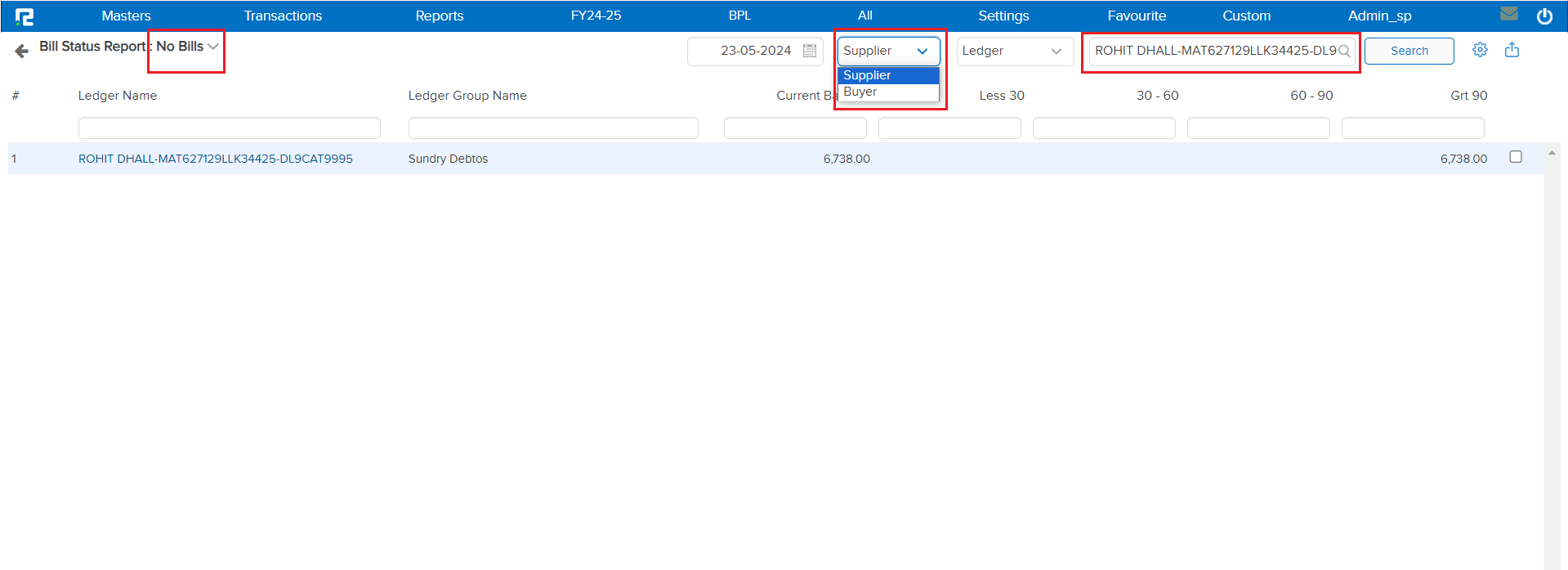

d. No Bills

In this report by selecting the Supplier or Buyer under the option you can identify the accounts or entities for which no bills have been issued.

Use Case: It is useful for ensuring that billing is completed and no clients or projects are missed.

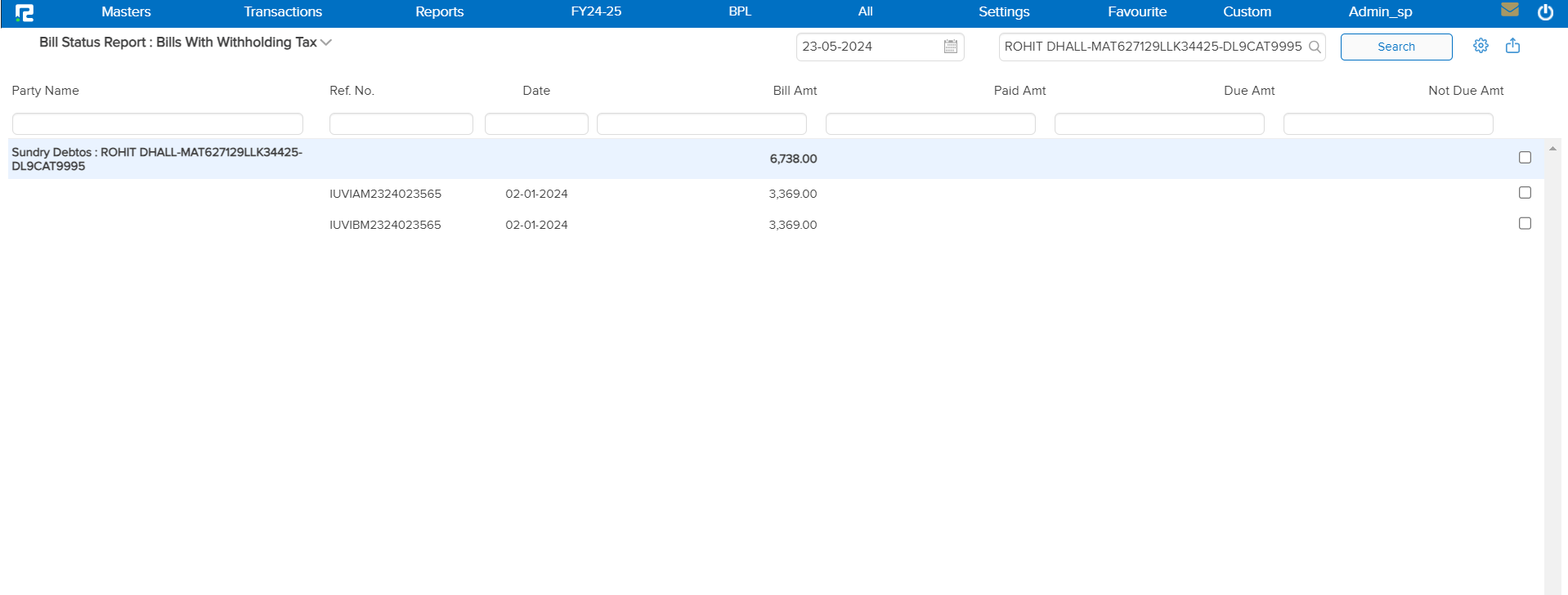

f. Bills With Withholding Tax

Details bills that have withholding tax applied to them, showing the amount withheld.

Use Case: Essential for tax reporting and compliance, helping to manage and track bills with tax deductions.

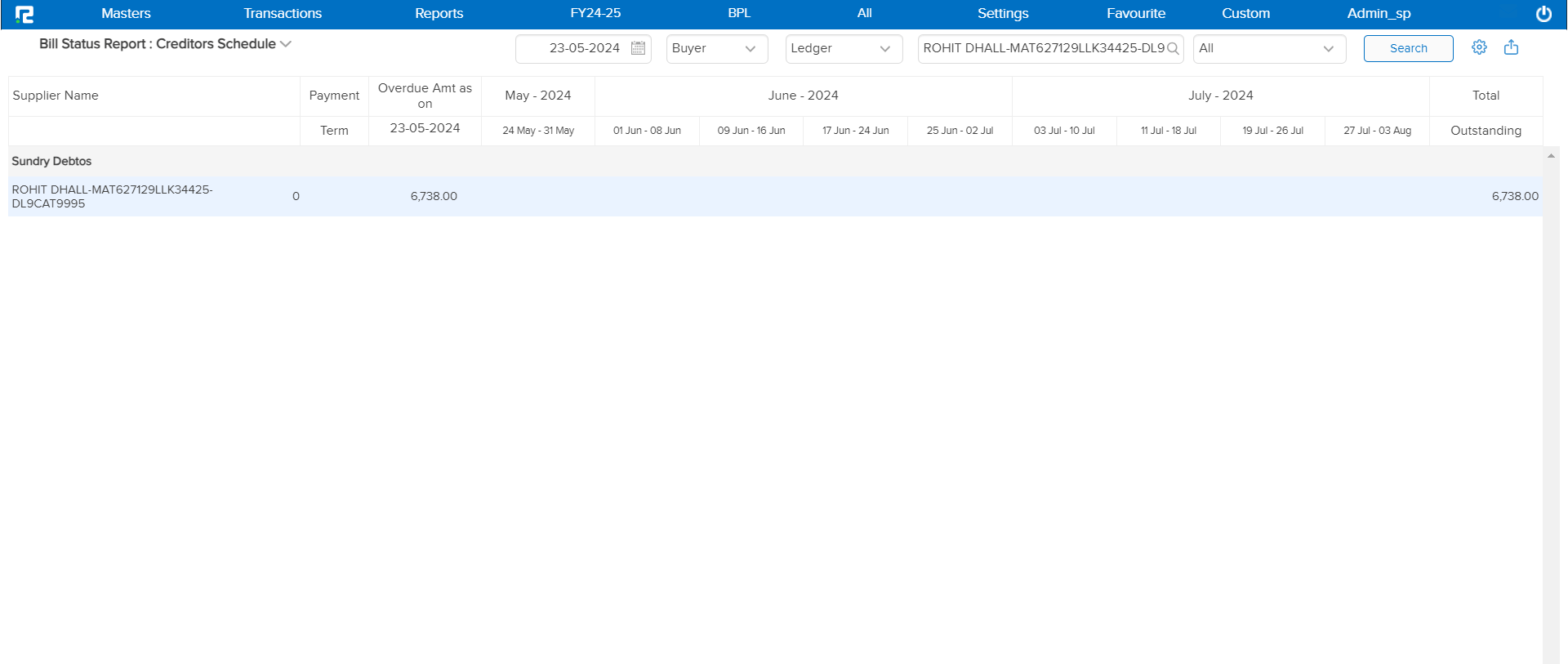

f. Creditors Schedule

This report provides a detailed list of all creditors, including overdue amounts, due dates (Monthly basis), and aging of the bills (how long they’ve been outstanding).

Use Case: Helps in managing payables, planning cash flow, and ensuring timely payments to creditors.

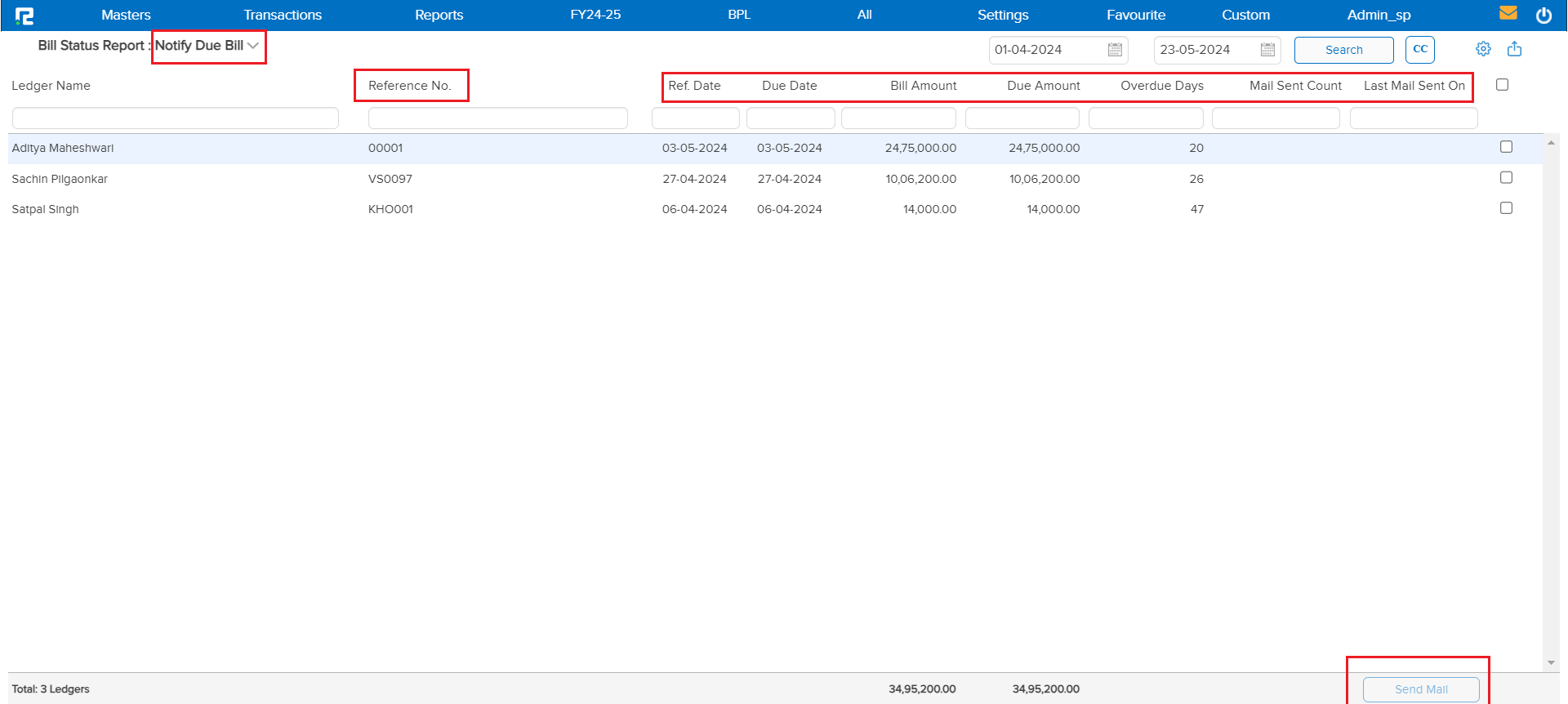

g. Notify, Due Bills

This report provides detailed bills that are due or nearly their due dates including “Bill Reference Number”, “Date”, “Due amount”, and “Overdue days. Potentially trigger a notification for follow-ups with a “Send mail” option.

Use Case: Ensures timely payments, helping to avoid late fees and maintain good relationships with creditors.