An invoice voucher type is used to create a document that is issued by a seller to the buyer. The accounting invoice helps in the creation of a service invoice.

How to Raise an Invoice (With Manual GST)

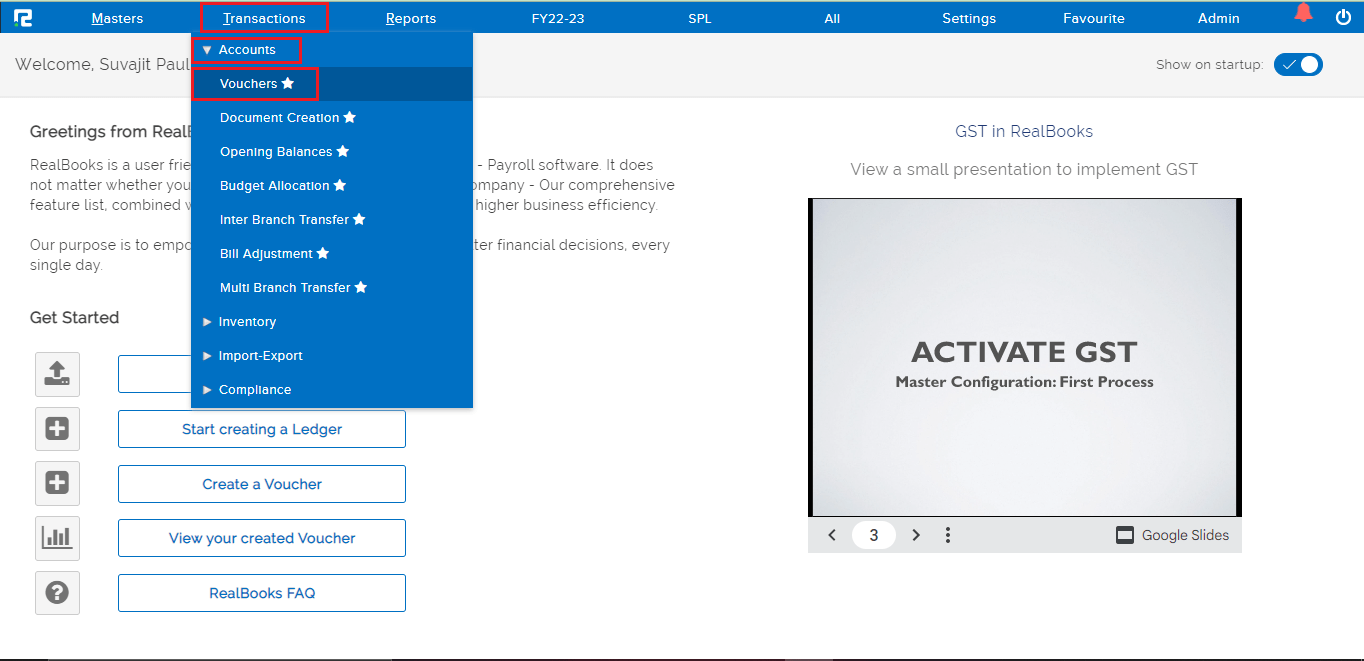

STEP 1: Go to Transactions ⇒ Accounts ⇒ Vouchers

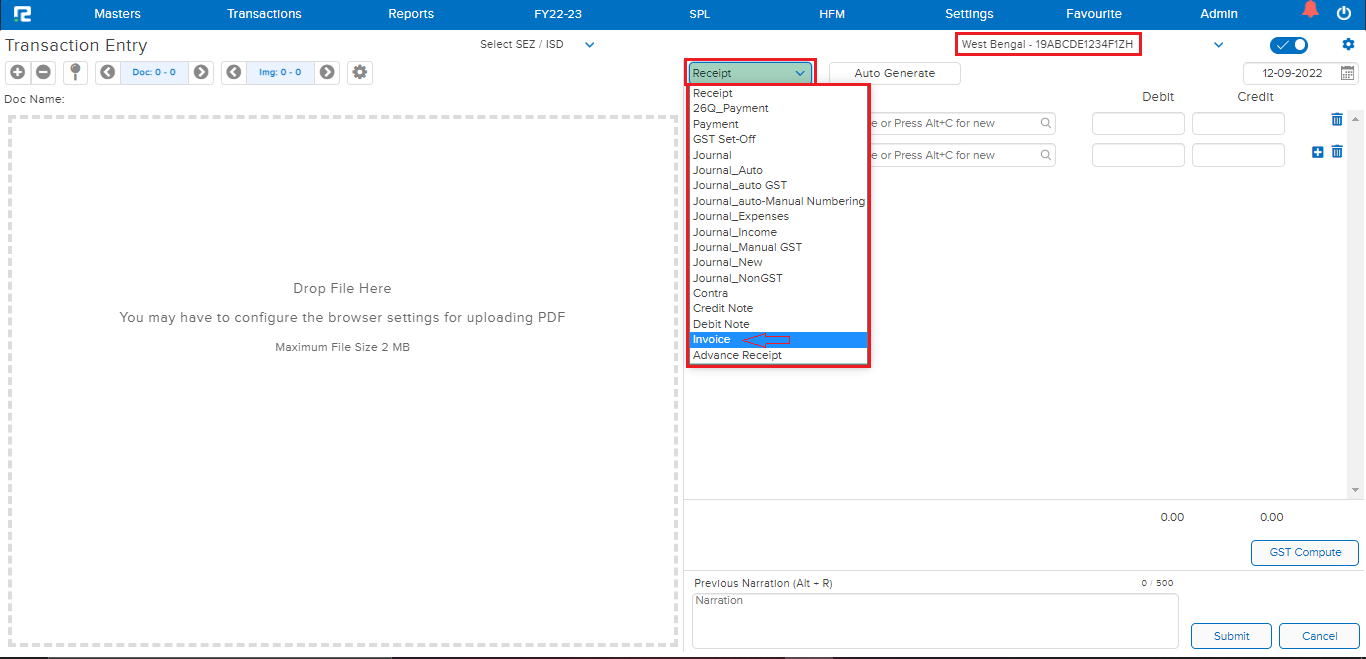

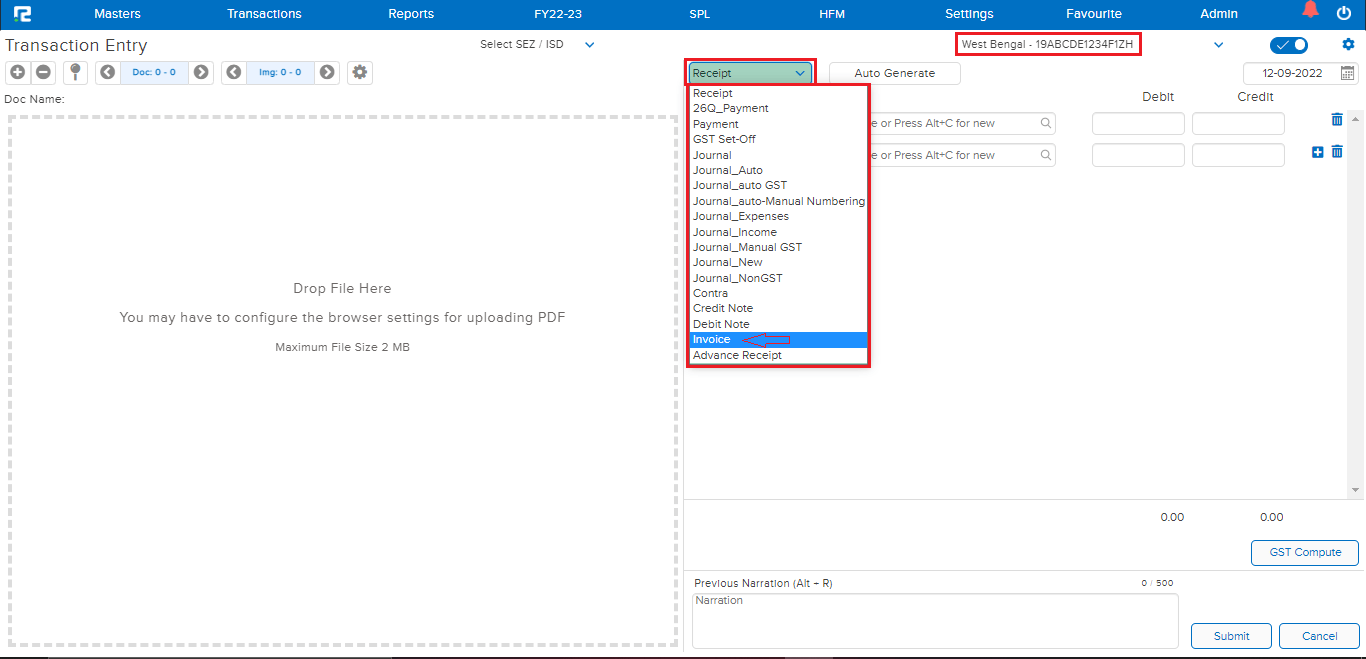

A Transaction Entry page will open. Select the “Invoice” Voucher type from the Dropdown list. The Business place as per GST is displayed by default, however in case of Multiple Business Places, the same can be selected from the Dropdown list. Modify the Voucher Date, if required.

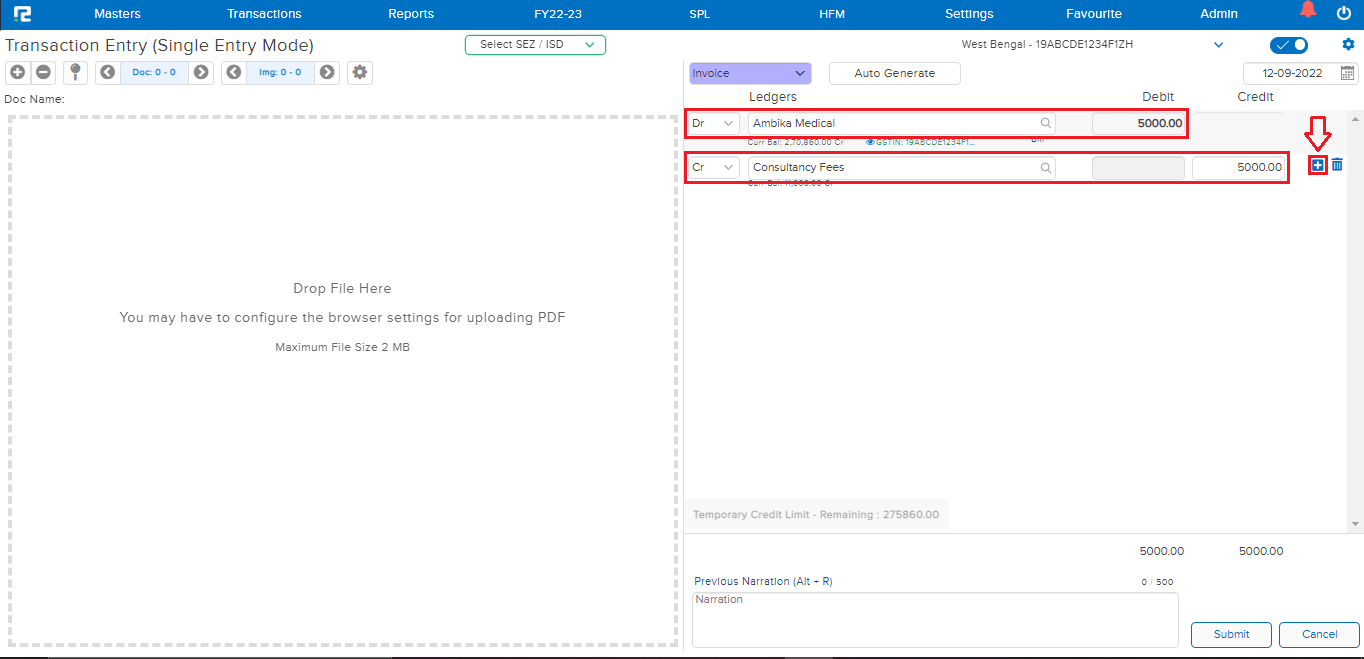

STEP 2: On the Debit Side, search the party ledger (type minimum 3 letters, then select the ledger) and put the bill amount.

Note: If the Bill Feature is enabled in Party Ledger master, then the bill details will get captured.

STEP 3: On the Credit side, search the income ledger and enter the amount.

To insert the GST details, click on the “+” icon or press enter, so that new row gets added.

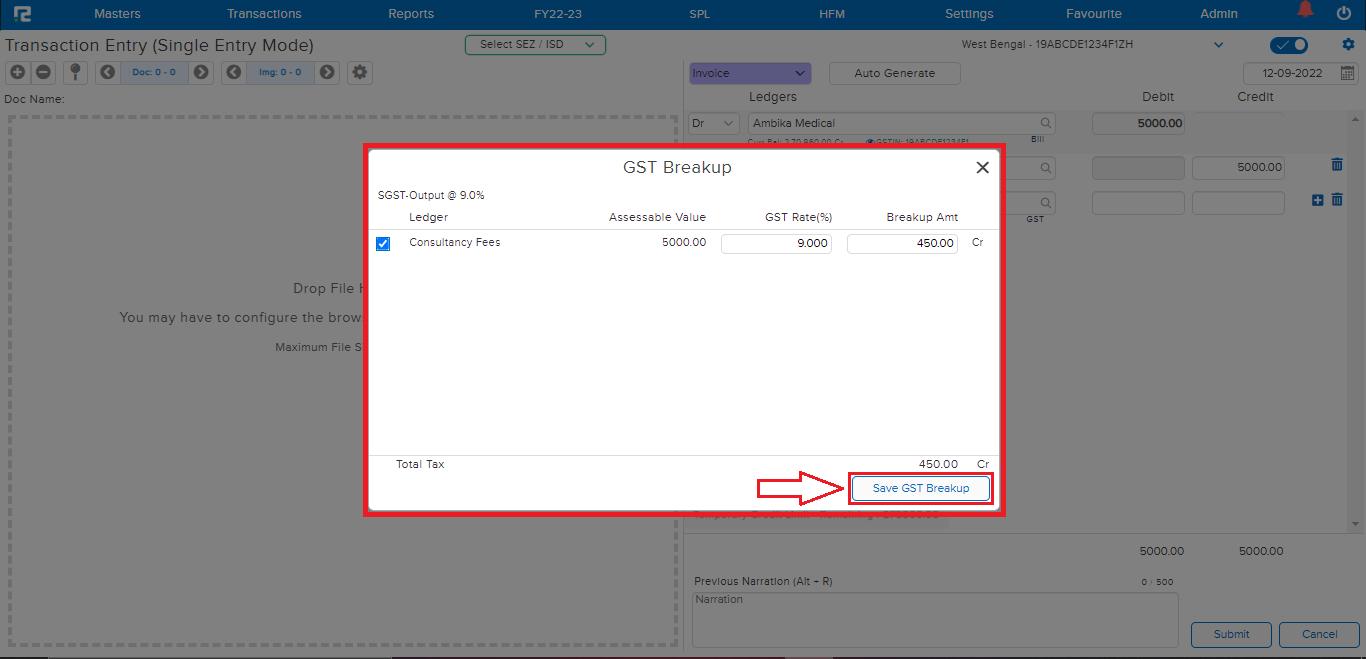

STEP 4: Search the GST Output Ledger, on selecting the same, the GST Breakup pop-up will appear, make the necessary changes, click on Save GST Breakup.

STEP 5: The GST amount as per the break up will populate on the Credit Side. In case of Intra-State GST, both SGST & CGST needs to be entered, in case of IGST only one row for IGST output needs to be entered.

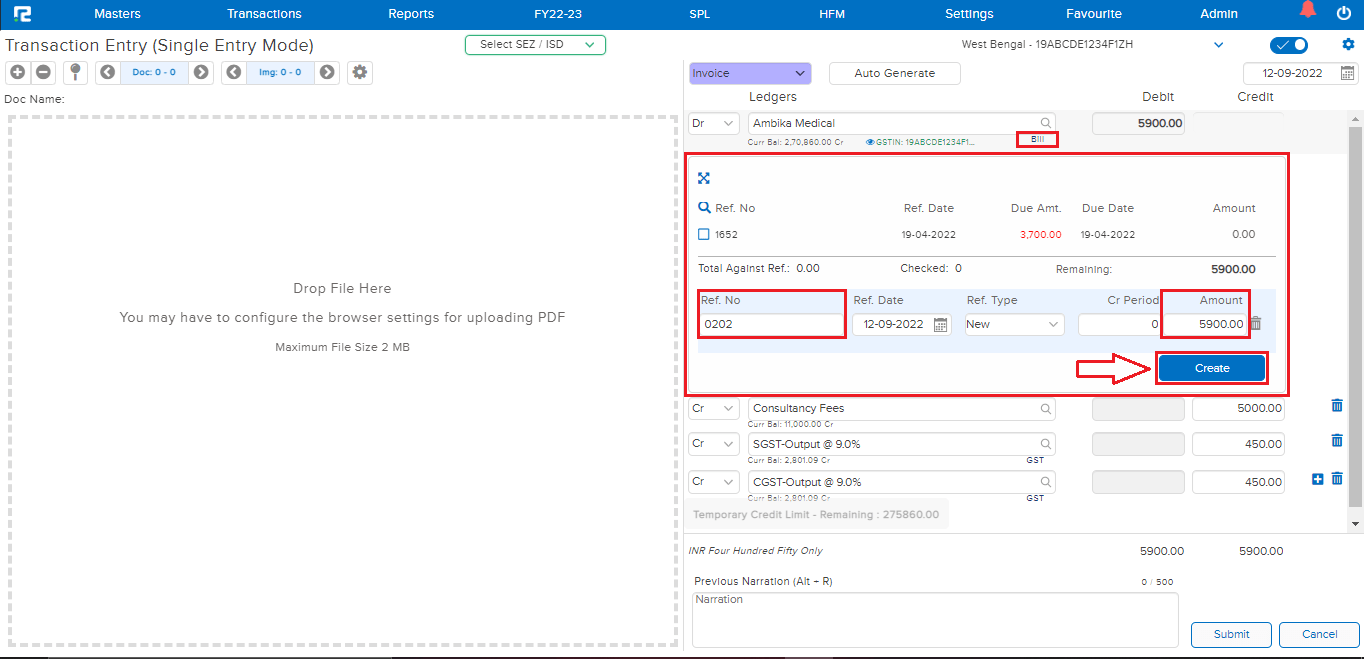

STEP 6: CLICK on the “BILL” option and update the invoice value, once done, click on Create.

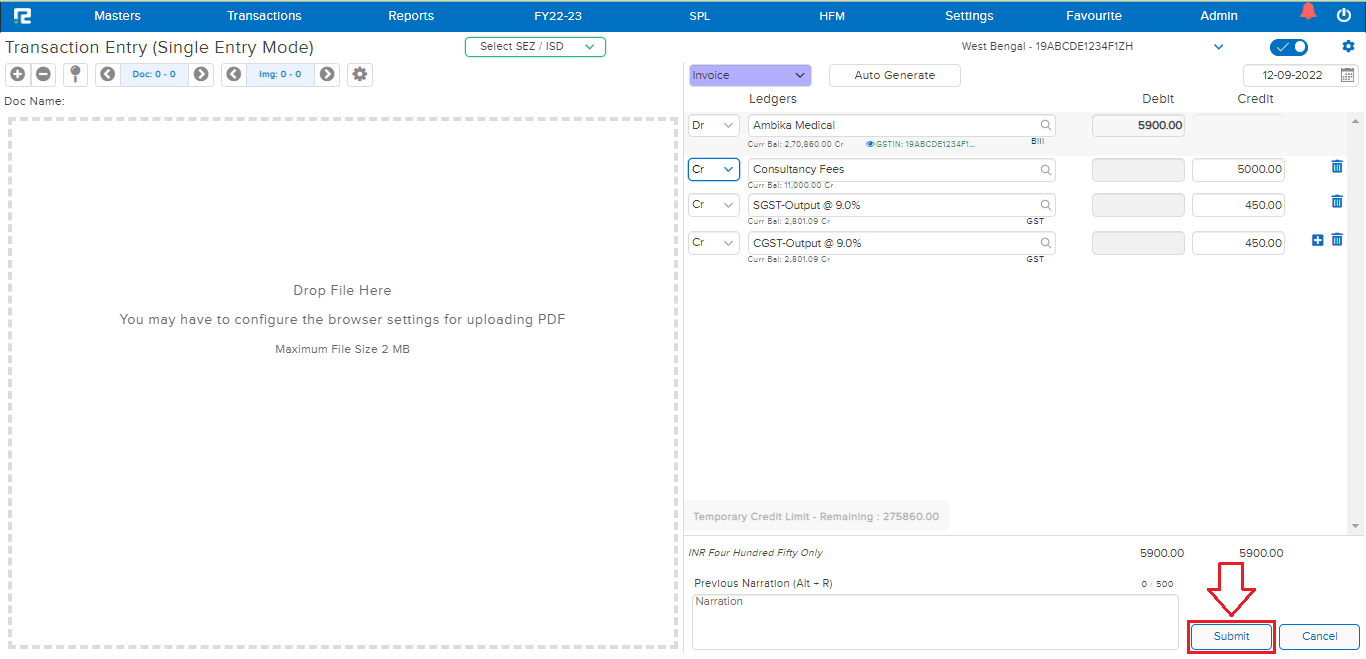

STEP 7: CLICK on SUBMIT present at the right-side bottom and the invoice entry will be created and saved successfully.

How to Raise an Invoice (With Automatic GST)

STEP 1: Go to Transactions ⇒Accounts ⇒ Vouchers

A Transaction Entry page will open. Select the “Invoice” Voucher type from the Dropdown list. The Business place as per GST is displayed by default, however in case of Multiple Business Places, the same can be selected from the Dropdown list. Modify the Voucher Date, if required.

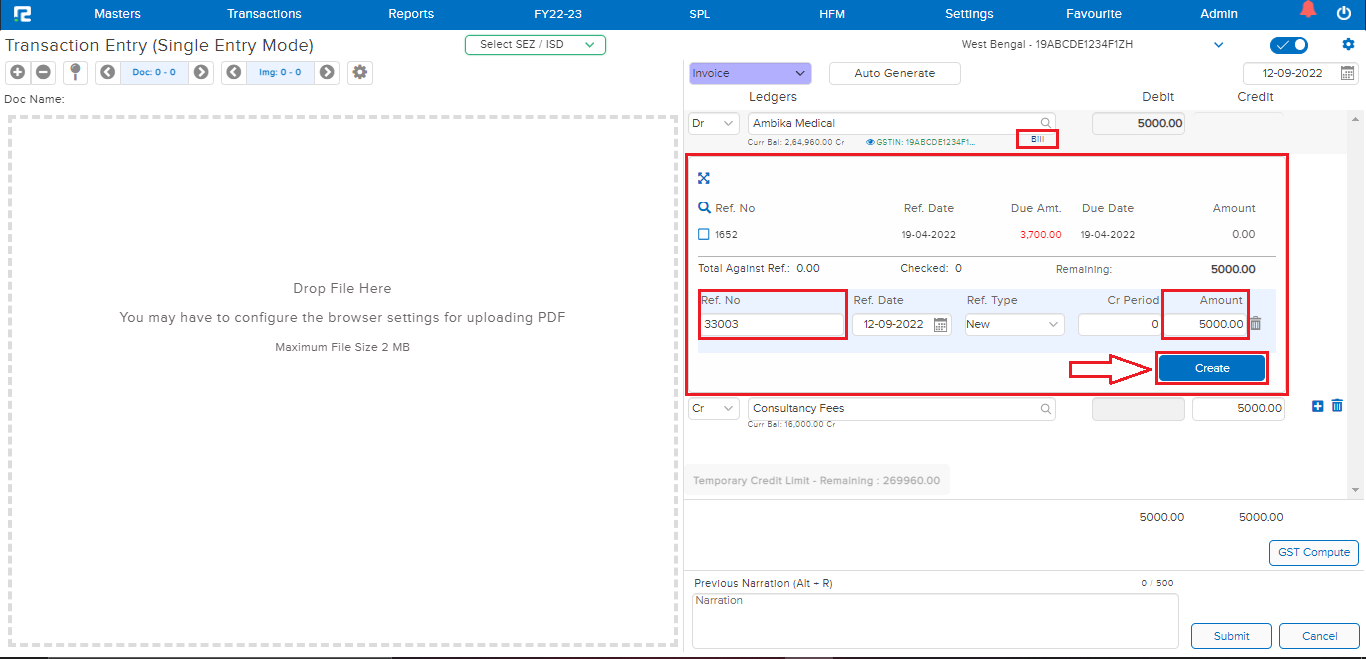

STEP 2: On the Debit Side, search the party ledger (type minimum 3 letters, then select the ledger) and put the bill amount.

Note: If the Bill Feature is enabled in the Vendor ledger master, the Bill Table will open.

STEP 3: Enter the Bill details, and click on Create.

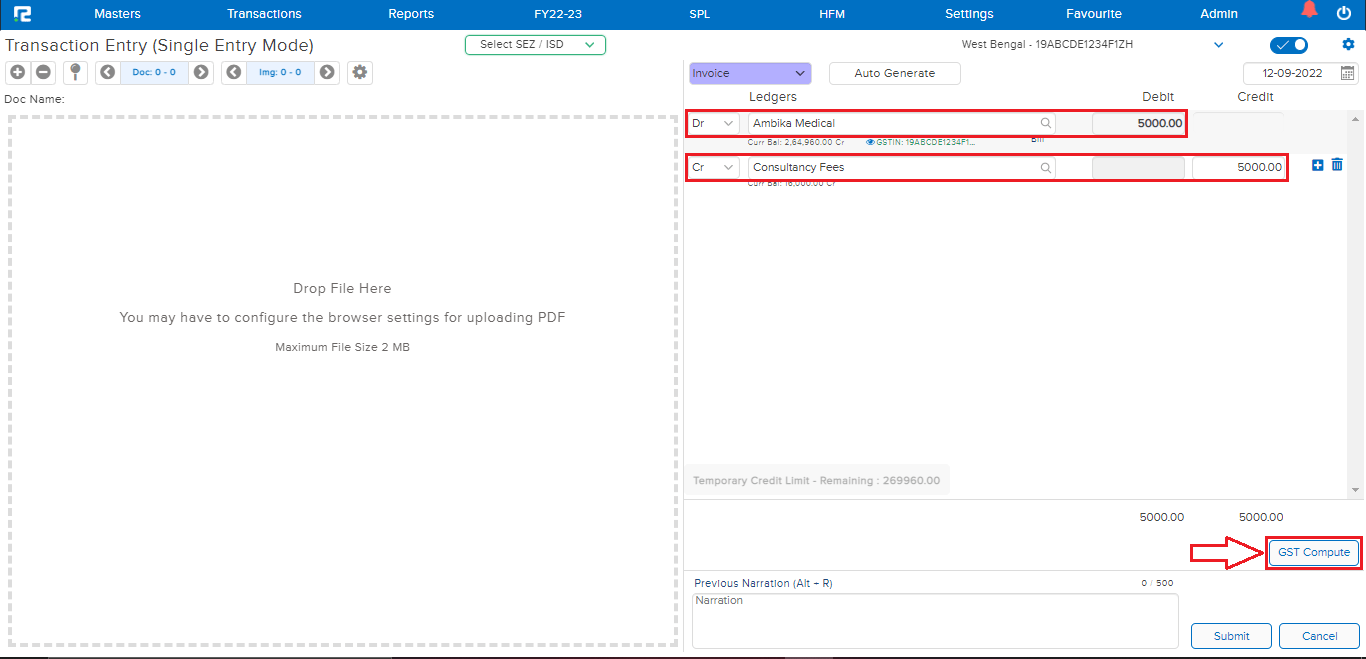

STEP 4: On the Credit side, search the income ledger and enter the amount.

STEP 5: CLICK on “GST COMPUTE” to auto-calculate the GST as per the Tax rate configured in the income ledger master.

Note: To use Automatic GST computation, configure GST Calculation as Automatic in Voucher Master.

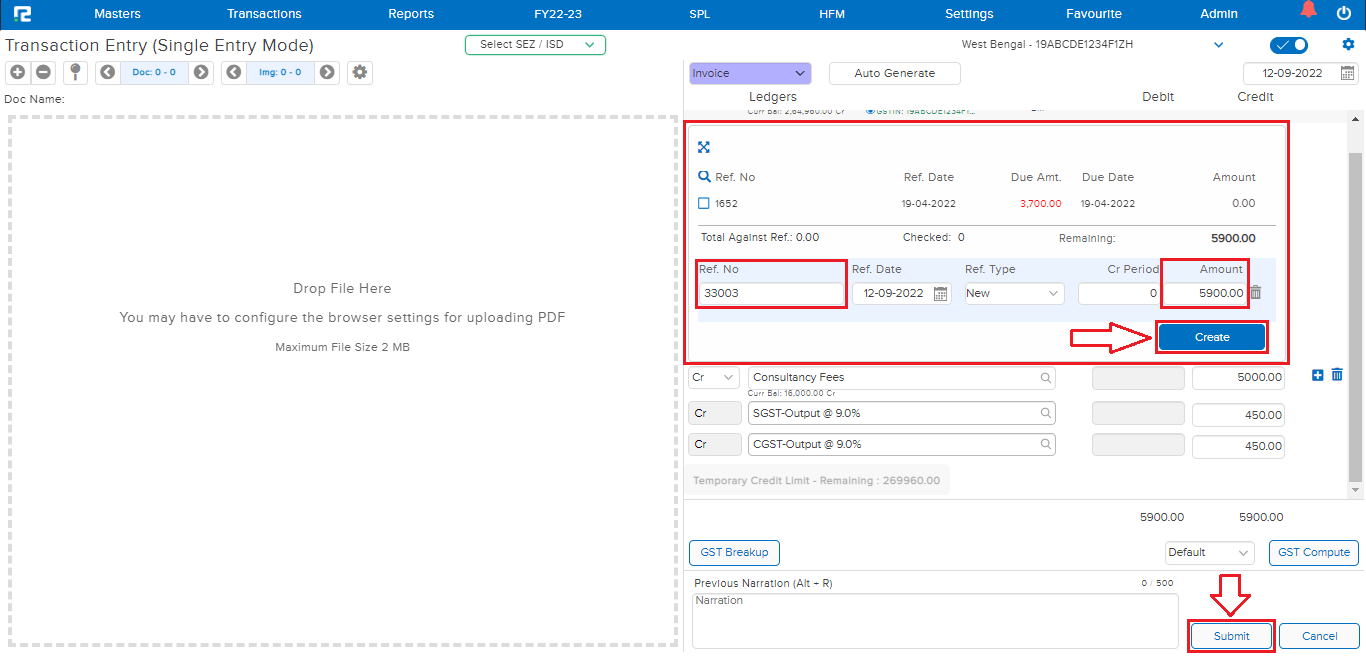

STEP 6: The bill pop-up opens, update the invoice value, and once done, click on Create.

STEP 7: CLICK on the “SUBMIT” button to save the voucher.

How to Edit an Invoice Entry

Users can view, edit, cancel, or delete an invoice entry from almost every report available in the system. For ex: daybook, ledger report, etc.

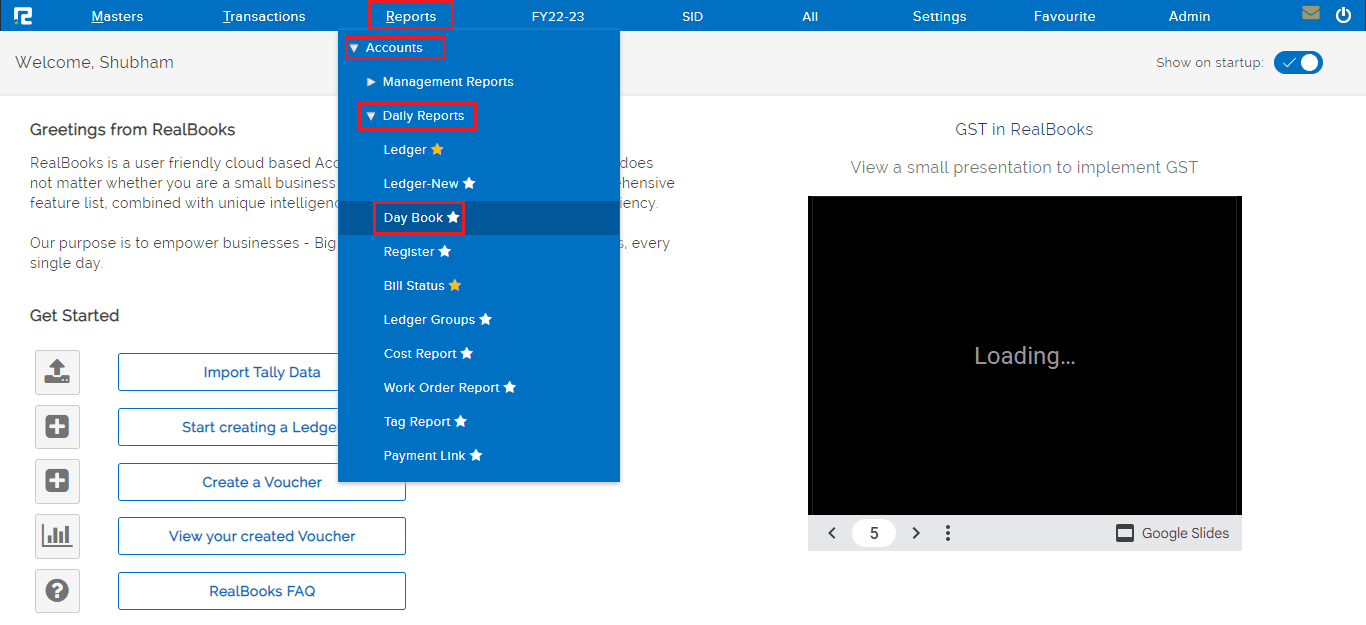

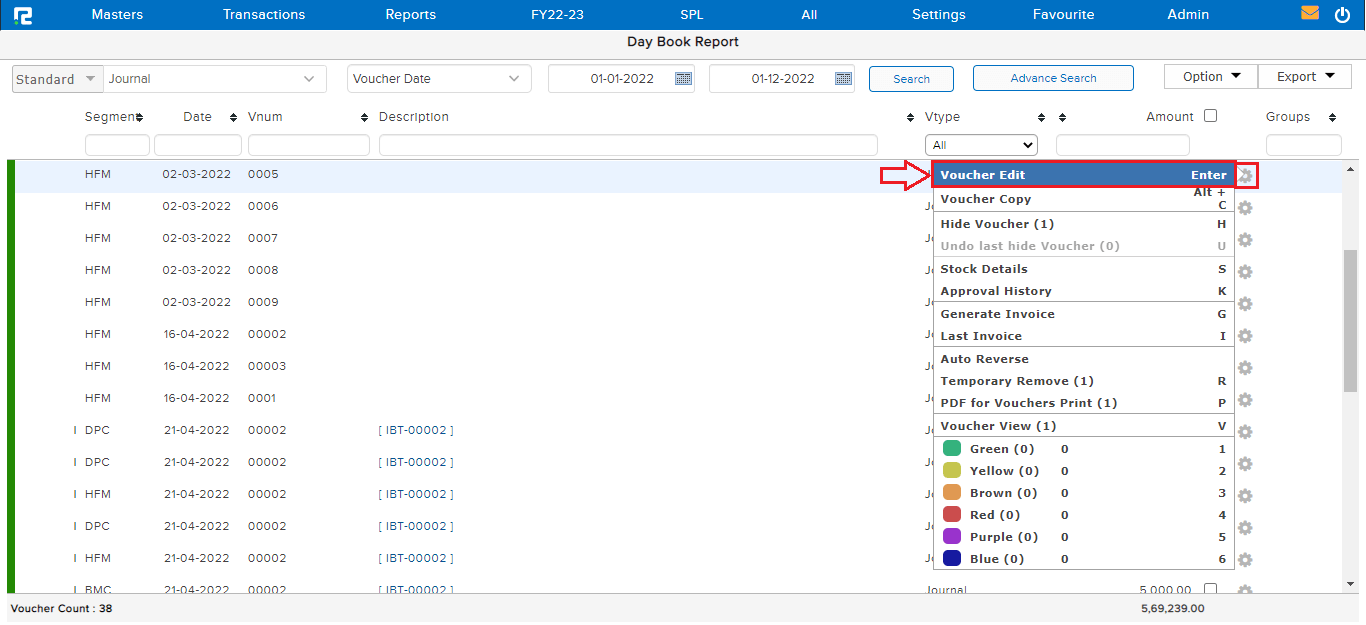

TRANSACTION EDIT VIA DAY BOOK

Go to Reports⇒ Accounts⇒ Daily reports⇒ Day Book

To edit an entry, click on the settings icon on the right-hand side of the entry & click on the Voucher Edit option, or alternatively, press Enter on the keyboard.

Do the necessary changes as required and click on the submit button.

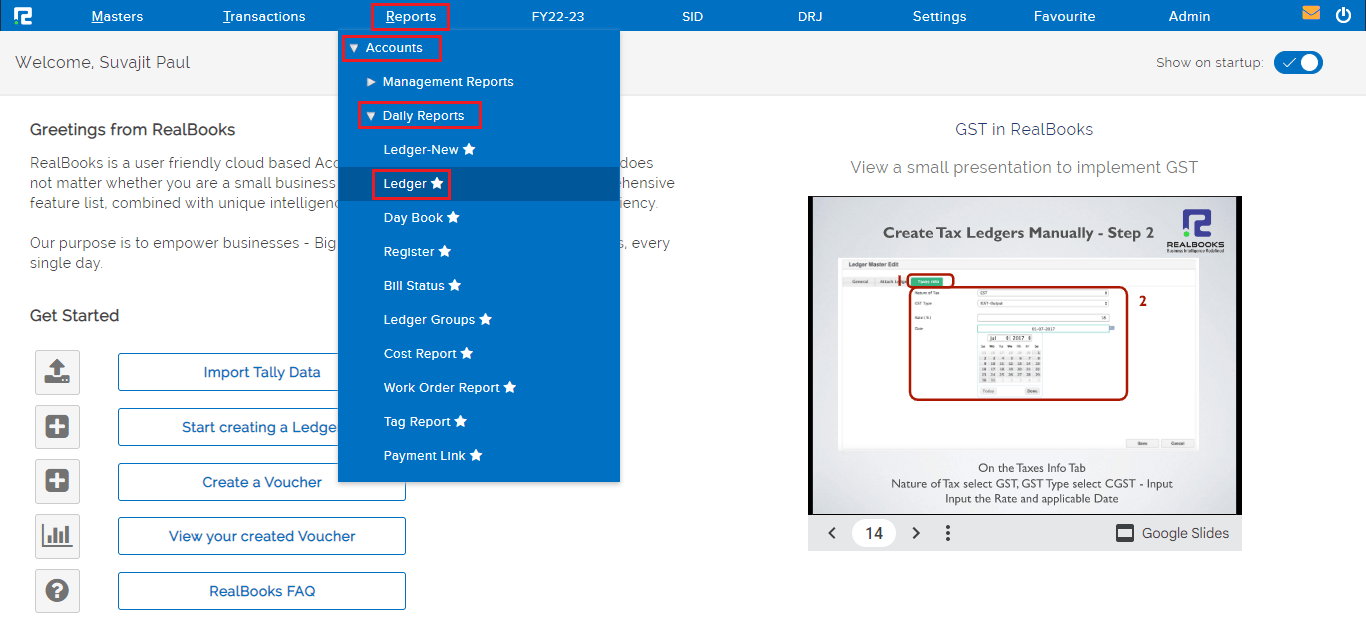

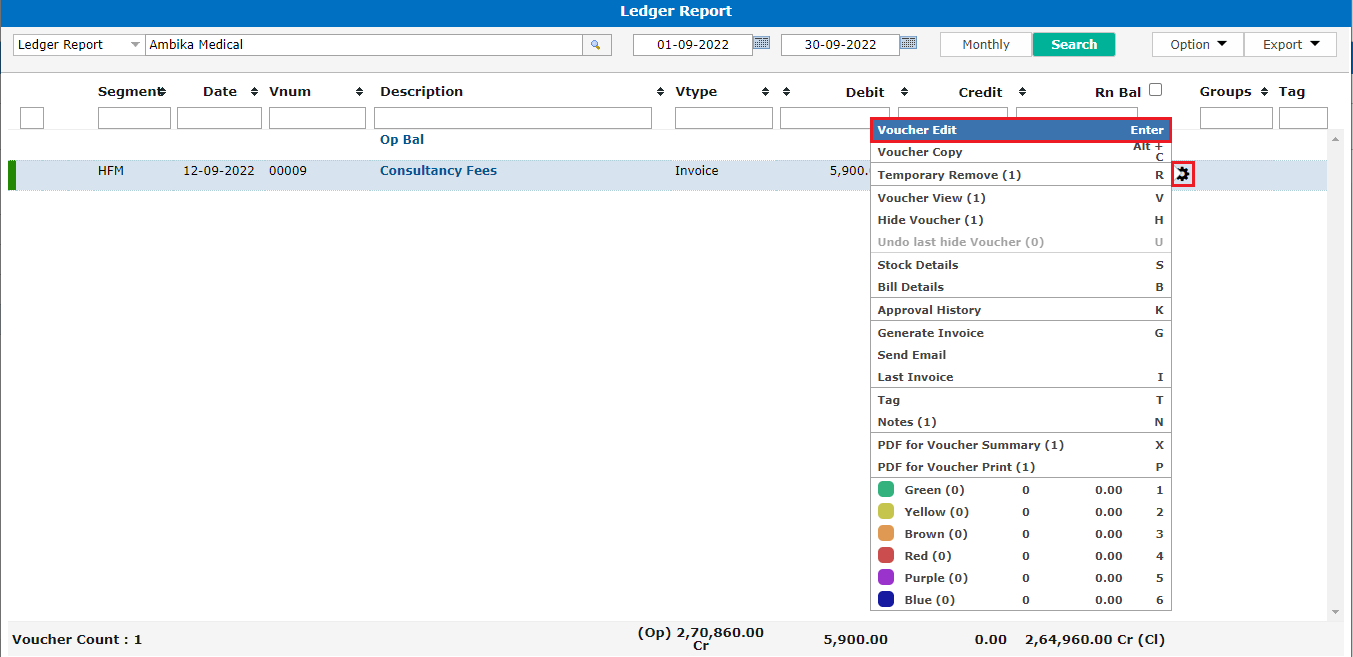

TRANSACTION EDIT VIA LEDGER REPORT

Go to Reports⇒ Accounts⇒ Daily reports⇒ Ledger

To edit an entry, click on the settings icon on the right-hand side of the entry & click on the Voucher Edit option, or alternatively, press Enter on the keyboard.

Do the necessary changes as required and click on the submit button.

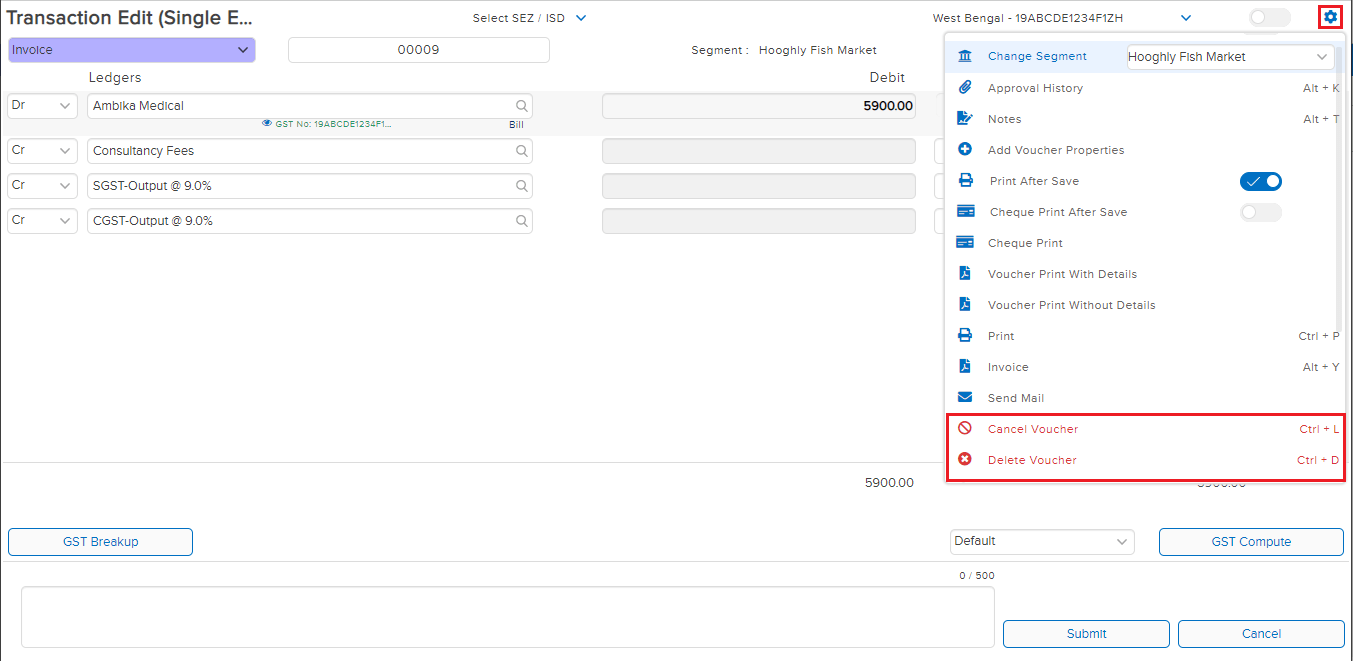

How to Delete or Cancel an Entry

DELETE/CANCEL– To cancel/delete an entry, open the entry in edit mode, then go to the Settings icon on the right-hand side of the page. From the dropdown menu select the cancel/delete voucher as required, enter the reason for cancellation/deletion, and then click on cancel/delete.